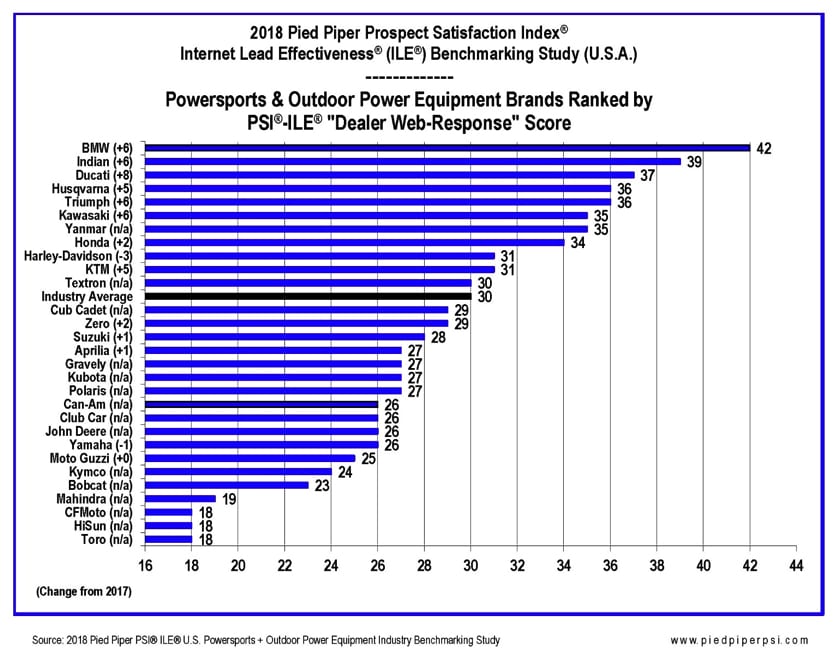

Customer internet queries get best response from BMW dealers: Pied Piper PSI study

BMW motorcycle dealerships ranked highest in the 2018 Pied Piper PSI Internet Lead Effectiveness (ILE) Industry Study, which measured how motorcycle and UTV dealerships responded to customer inquiries received through dealership websites. Study rankings by brand were determined by the Pied Piper PSI process, which ties “mystery shopping” measurement and scoring to dealership sales success.

Dealerships selling Polaris’ Indian motorcycle brand were ranked second, followed by Ducati, Husqvarna, Triumph, Kawasaki and Yanmar. Brands which improved the most from year to year were Ducati, Kawasaki, Triumph, Indian and BMW. Brands suffering a decline from year to year were Harley-Davidson and Yamaha.

Pied Piper sent customer inquiries through the individual websites of 3,175 dealerships, asking a question about a vehicle in inventory, and providing a contact name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded over the next 24 hours. A total of 19 different measurements generated a dealership’s PSI-ILE score.

The year 2018 marks the first time that Outdoor Power Equipment brands selling UTVs were included as part of this study. In contrast, Powersports brands selling motorcycles have been measured annually for each of the past three years, and most Powersports brands improved their performance substantially from 2017 to 2018. For 2018, Powersports brands captured nine of the ten highest rankings, with seven brands achieving double-digit percentage improvement in their PSI-ILE score from 2017 to 2018.

Response to customer web inquiries varied substantially by brand, and by dealership within each brand. For example, on average only 45% of customers received a personal reply within 24 hours. But more than 60% of Indian, BMW, Ducati and Yanmar customers received a personal reply on average, while less than 30 percent of HISUN, CFMOTO or Toro customers received a personal reply on average.

The following are additional examples of performance variation by brand:

- How often did the brand’s dealerships fail to respond in any way – not even an automated reply?

— Failed to respond less than 10% of the time: Can-Am, Harley-Davidson, Honda, Yamaha

— Failed to respond more than 35% of the time: HiSun, Kubota, Gravely, CFMoto, Club Car, Moto Guzzi

- How often did the brand’s dealerships provide a personal response within 60 minutes?

— More than 30% of the time: Indian, Honda, Kawasaki, BMW, Ducati

— Less than 10% of the time: Kubota, Toro, CFMoto

- How often did the brand’s dealerships answer the customer’s specific question?

— More than 50% of the time: Yanmar, BMW, Ducati

— Less than 20% of the time: Harley-Davidson, Toro, HiSun

- How well did the brand’s dealership reply emails avoid the customer’s spam/junk mail folder?

— Landed in customer spam/junk mail folder less than 5% of the time: Suzuki, John Deere, Aprilia, Bobcat, Kubota, Gravely

— Landed in customer spam/junk mail folder more than 20% of the time: Harley-Davidson, Can-Am

- How often did the brand’s dealerships attempt to contact the customer by telephone?

— More than 40% of the time: Harley-Davidson, Yamaha, Can-Am

— Less than 10% of the time: Mahindra, Toro, Club Car, Cub Cadet, Gravely

Some brands and dealerships try to reply to website customers by both email and phone, while others reply exclusively by email, or exclusively by phone.

“The industry’s highest web-lead sales close rates come from providing an emailed reply followed quickly by a phone call,” said Fran O’Hagan, President and CEO of Pied Piper. “Why not just rely on an email? Because customers will never see one out of five dealership emails because they will land in the customer’s spam/junk mail folder. Then why not just phone the customer, and forget the email? Because of the very poor odds of reaching the customer by phone. This year’s study showed that salespeople attempted to phone website customers on average only 43% of the time, and only about 40% of customers will answer their phone. Because of that math, salespeople on average will speak live to only one in six of their website customers, and leaving a voicemail does not help much since we now listen to less than one-third of our voicemails.”

Many Powersports and Outdoor Power Equipment dealerships are lean-staffed, making it challenging for employees to drop what they are doing to respond quickly to customer website inquiries. However, Pied Piper has found that a dealership consistently following three basic “best practices” will outperform 80% of the Powersports and Outdoor Power Equipment industry:

- Make sure CRM auto-responder is set up correctly and is working. Use the auto-responder as a “print ad” to sell the dealership, (“you’ve come to the right place”), to immediately acknowledge the customer, and to confirm dealership contact information.

- Personally respond at least once every day to all customer web inquiries to answer the customer’s questions, address any stated needs, and introduce a specific person committed to helping the customer. “Don’t leave your customers—even if they are website customers—locked-up in your dealership overnight,” said O’Hagan.

- Immediately follow-up the personal email with a telephone call to “be helpful”. “Wanted to let you know that I responded to your inquiry” – this also helps address the issue that about one in five dealer emails are never seen by customers since they end up in customer spam/junk mail folders.

The last step to website customer sales success is to continually measure what is “really” happening when customers attempt contact through a dealership website. Given how many customers today first meet a dealership through the dealer website, why aren’t all of today’s dealership responses quick and complete? “There are three reasons for poor performance,” said O’Hagan. “First of all, this is a part of the business where employee actions can be invisible to management unless management is vigilant and pays attention to what is really happening. Secondly, it’s not easy to be perfect every hour of every day, with customer inquiries never falling through the cracks. And third, we often see failures of third-party software, either inadvertently keeping customers out with overaggressive bot/spam prevention, or losing dealer reply emails to customer spam/junk mail folders. Without measuring what is ‘really’ happening, these failures are invisible.”

The 2018 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Powersports & Outdoor Power Equipment Industry Study (U.S.A.) was conducted between August 2017 and July 2018 by submitting customer internet inquiries directly to a sample of 3,175 dealerships nationwide representing all major brands. Examples of other recent Pied Piper PSI studies are the 2018 Pied Piper PSI (In-Person) U.S. UTV Industry Study, in which BRP’s Can-Am brand was ranked first, the 2018 Pied Piper PSI-ILE (Internet) U.S. Auto Industry Study in which Mercedes-Benz was ranked first, and the 2018 Pied Piper PSI (In-Person) U.S. Auto Industry Study in which Audi was ranked first. Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI “mystery shop” evaluations—internet, telephone, or in-person—as tools to improve the sales effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the proprietary PSI process, go to www.piedpiperpsi.com.