Dealer outlook deteriorates in Q2: survey

After three improving quarters, business conditions decline

Reversing the trend of sequential improvement that’s been observed in the prior three quarters, only 63 percent of dealers categorized business conditions as either average, good, or very strong in the second quarter, down from 80 percent in the first quarter in the first quarter of 2017 and 67 percent in the second quarter of 2016.

However, 52 percent of dealers called out weather as having a negative impact on their results. Still, even with a weather excuse at the ready, dealer outlooks have also deteriorated in this survey.

Those are among the findings in the Q2 2017 Powersports Business/BMO Capital Markets Dealer Survey.

A total of 96 dealers from 39 states and four Canadian provinces, who combined to represent 50 franchises, participated in the survey. States that did not have a dealership represented in the survey were Delaware, Georgia, Hawaii, Nebraska, New Jersey, Oklahoma, Oregon, Rhode Island, Vermont, Virginia and Wyoming.

A total of 92 percent of the respondents have one dealership location. They sell the following segments: motorcycles (81 percent), traditional ATVs (81 percent), side-by-sides (76 percent), PWC/boats (35 percent) and snowmobiles (35 percent).

Only 13 percent of dealers reported that their Q2 business performance was above plan. Another 38 percent said they were on plan, and 49 percent said they were below plan.

A consistent source of feedback was that 2Q17 was a challenging quarter from a weather perspective, often times citing significantly more rain than usual in the quarter. Bad weather shortens the riding season, which in turns limits the window dealers can sell new product. Or, as one dealer declared: “The rainy spring weather has put a real damper on business. We will not recover sales lost over the past two months.”

The weather impact has weighed on results. But there’s also a fading of the “Trump Bump” as dealers begin to question the ability of the president to deliver on his promises. Performance and outlook metrics this survey tracks are all deteriorating to pre-election levels. Or, as one dealer described: “Trump chaos is killing interest in non-essentials like motorcycles.”

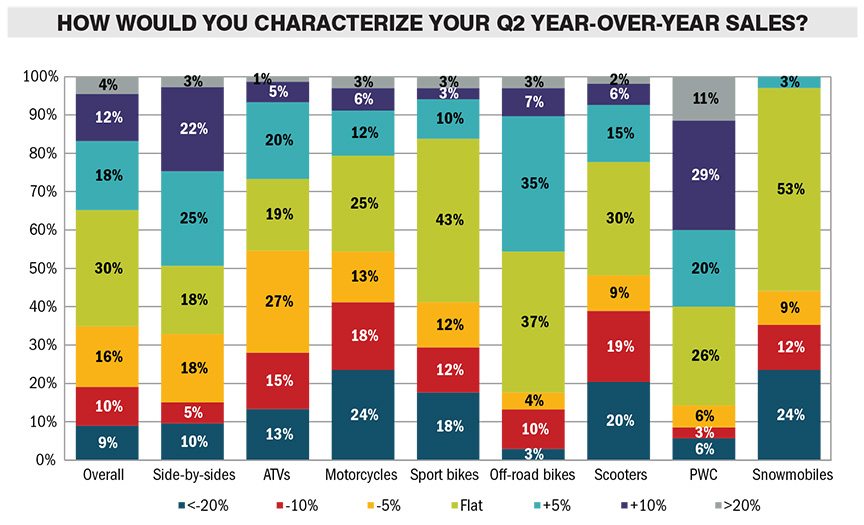

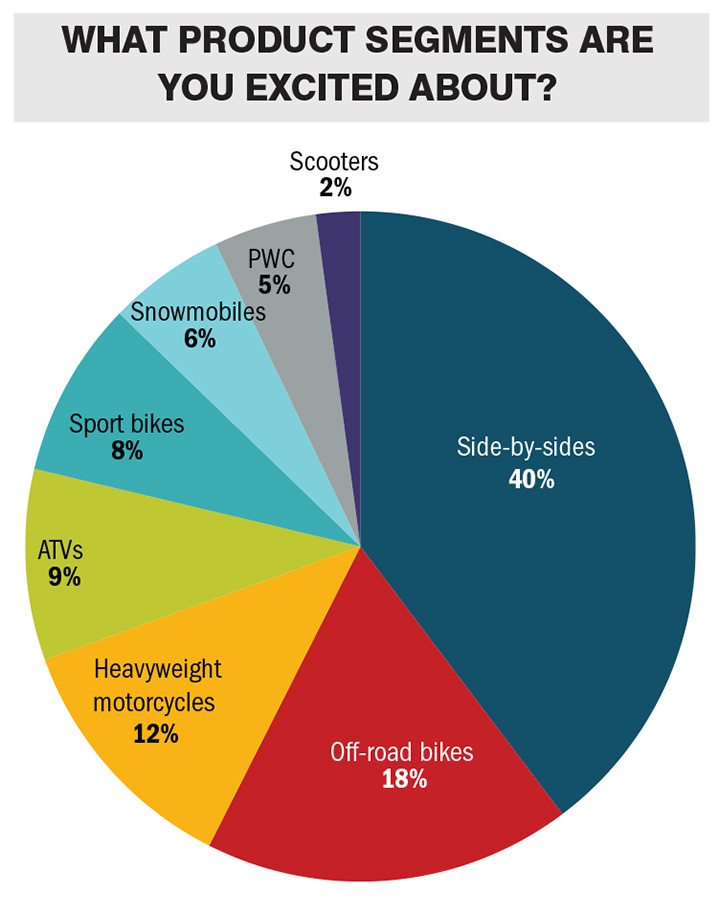

Dealers who sell PWC and boats continue to be the best-performing, as well as the most optimistic, dealer segment. After marine, side-by-side was the next strongest category, though feedback was weaker than it was in our 1Q17 survey. We note that side-by-sides are still the category showing the highest level of expected growth from dealers.

In the overall ORV business, Can-Am was the outperformer, with 71 percent of dealers reporting sales increases. Given feeback about how well the company’s Maverick X3 and Defender side-by-sides have been selling, such strong performance isn’t surprising. Honda also did well with 68 percent of dealers reporting sales increases, with dealers indicating strong performance of its Pioneer side-by-side.

Once again, Polaris was in the middle of the pack, with 44 percent of dealers seeing an increase in sales and 56 percent seeing a decline. This is down sequentially from the Q1 survey, when 49 percent of Polaris dealers reported growth.

Bringing up the rear, 80 percent of Suzuki dealers reported a decline in sales, as the lack of a side-by-side offering is hurting that brand.

Dealers interested in participating in the Q3 survey should send an email to editor Dave McMahon at dmcmahon@powersportsbusiness.com. Five dealers who complete the survey are selected at random to win a $100 gift card. In addition, dealers receive a complete analysis of the data from BMO Capital Markets analyst Gerrick Johnson. Dealers who completed the Q2 survey received a 21-page PDF worth of valuable data.

Interested in learning more about how the industry performed at the retail level in Q2 2017? Download the 10-page PDF of the dealer survey results for $39.99 at www.powersportsbusiness.com/digital-downloads.