BMW dealers rank No. 1 in prospect study

Prospect Satisfaction Index reveals in-dealership treatment of U.S. motorcycle shoppers

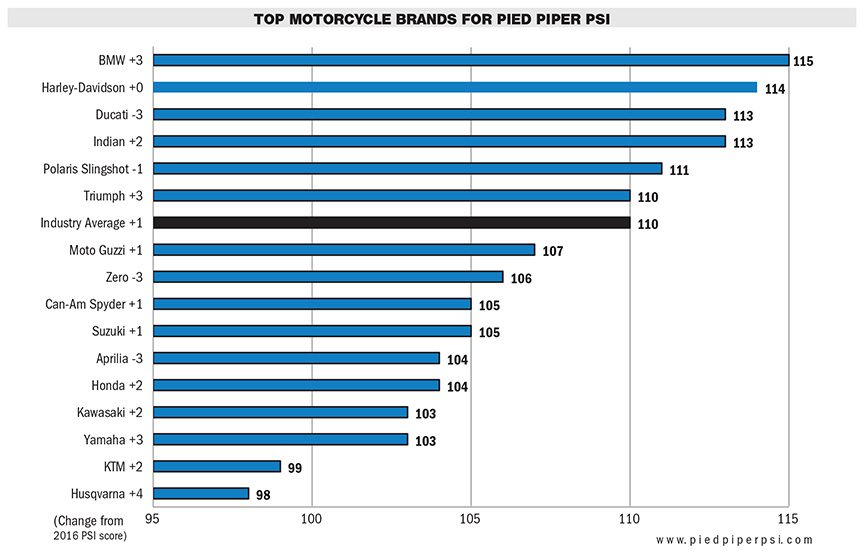

BMW motorcycle dealerships were the top ranked brand in the newly released 2017 Pied Piper Prospect Satisfaction Index U.S. Motorcycle Industry Benchmarking Study. The study measured treatment of motorcycle shoppers who visited a dealership, with rankings by brand determined by the Pied Piper PSI process, which ties “mystery shopping” measurement and scoring to industry sales success.

Harley-Davidson dealers were ranked second, while Polaris Industries’ Indian brand and Audi AG’s Ducati brand finished tied for third.

Five years ago, BMW dealerships performed below the industry average, with a PSI score of 98, but since then the BMW average PSI score has improved every year as sales behaviors have changed. For example, compared to their performance five years ago, BMW dealers in 2017 were 50 percent more likely to mention test rides, were 60 percent more likely to encourage going through the numbers or writing up a deal, and were 30 percent more likely to ask for contact information to allow for follow up.

Brands showing the greatest overall improvement over the past year were Husqvarna, BMW, Triumph and Yamaha. Brands with declines from 2016 to 2017 were Ducati, Aprilia, Zero and dealerships selling the Polaris Slingshot. Eleven of 16 brands improved, which generated an industry average PSI score of 110, a one-point increase from 2016, and the highest score Pied Piper has measured for an annual motorcycle industry study.

Sales process steps with the greatest improvement over the past year included involving the shopper with visual aids, attempting to forward the sale, giving compelling reasons to buy from the dealership and going through the numbers or writing up a deal. Aspects of selling that decreased from 2016 to 2017 included asking why the shopper considered the brand, encouraging the shopper to sit on a motorcycle and offering a test ride.

Performance varied considerably from brand to brand, including the following examples:

• Sell the dealership, not just the product. Dealers selling Indian, Ducati and Harley-Davidson were most likely to provide reasons why a shopper should buy from their dealership, rather than just selling the product. Dealers selling KTM, Zero and Can-Am were least likely to provide reasons to buy from their dealership. The national average was 47 percent of the time.

• Ask for the sale. Dealers selling Kawasaki and Harley-Davidson were most likely to ask for the sale in any way. Dealers selling KTM, Husqvarna and Zero were least likely to ask for the sale in any way. The national average was 72 percent of the time.

• Ask for contact information. Dealers selling Harley-Davidson, Triumph and Polaris were most likely to ask for shopper contact information. Dealers selling Yamaha, Husqvarna and Honda were least likely to request shopper contact information. The national average was 58 percent of the time.

“Motorcycle shoppers today visit dealerships half as many times before buying,” said Fran O’Hagan, president and CEO of

PiedPiper.

Motorcycle shoppers today gather much of their information online before ever visiting a dealership, and the result has been a drop from an average of four or more shopper visits before buying, to an average of two visits today.

“Successful motorcycle dealerships today not only respond quickly to customer web inquiries, but they also understand the increased importance of every customer visit,” said O’Hagan.

The 2017 Pied Piper Prospect Satisfaction Index U.S. Motorcycle Industry Study was conducted between July 2016 and April 2017 using 1,911 hired anonymous “mystery shoppers” at dealerships located throughout the U.S.

Examples of other recent Pied Piper PSI studies are the 2016 Pied Piper PSI Internet Lead Effectiveness (ILE) Motorcycle Industry Study, in which the U.S. BMW dealer network was top ranked, and the 2016 Pied Piper PSI (In-Person) U.S. Auto Industry Study, in which Nissan’s Infiniti dealer network was ranked first.