Dealers looking forward to 2017

Survey finds most dealers expect revenue growth

Fewer than half of the dealers recently polled by Powersports Business grew their 2016 revenue, however, three out of four expect to see an increase in 2017.

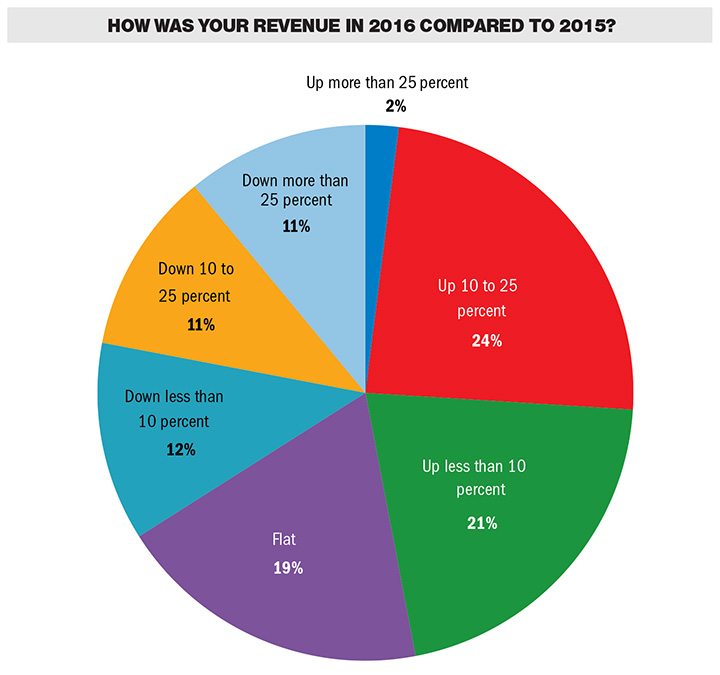

The December survey of 130 U.S. and Canadian dealers found that 47 percent of dealers grew their revenue in 2016. Another 19 percent reported flat revenue, and 34 percent saw a decrease.

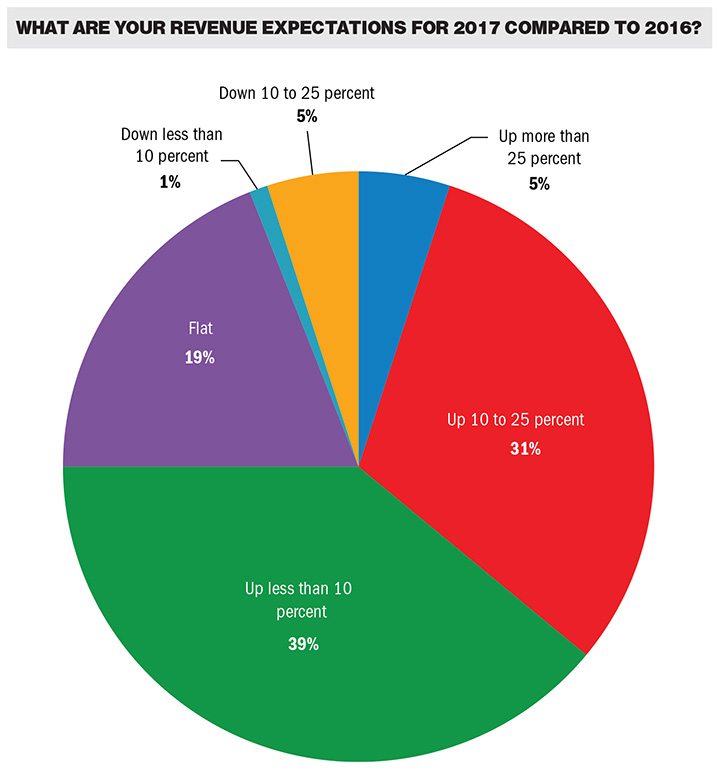

But there’s room for optimism going into 2017, as 75 percent of dealers said they anticipate revenue increases for the year. Nearly 40 percent of dealers expect their revenue to increase less than 10 percent, while 21 percent are seeking 10-25 percent growth, and 5 percent are projecting a jump of more than 25 percent.

Again, 19 percent expect flat growth, but only 6 percent are projecting a revenue decrease in 2017.

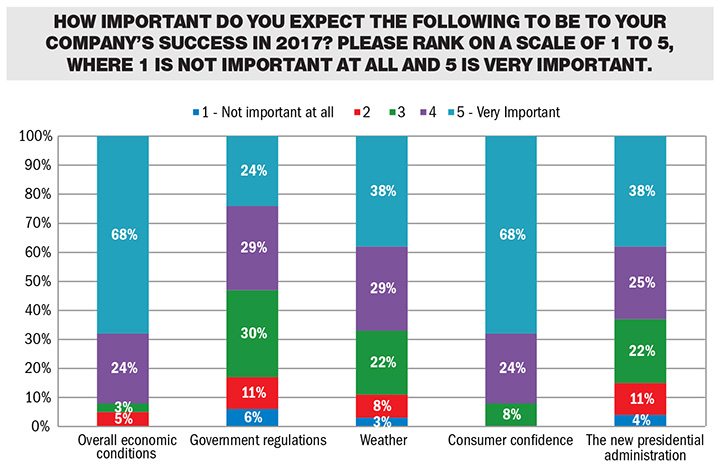

When looking toward the year, the overall economy is the biggest factor that dealers believe will affect their success. When asked to rank certain concerns on a scale of 1 to 5, with 1 being not important at all, and 5 being very important, 92 percent of dealers gave overall economic conditions a 4 or 5. The same number of dealers also ranked consumer confidence as a 4 or 5. More than half of all dealers also ranked the other factors in the survey as a 4 or 5. Government regulations were of least concern out of the five options given, with 47 percent of dealers giving it a 3 or less.

Powersports Business also asked dealers to rank which challenges to the powersports industry are most concerning to them, with 1 being unconcerned, and 5 being very concerned. Seven out of 10 dealers gave affordability a 4 or 5. And 67 percent ranked workforce challenges as a 4 or 5. The aging demographic of motorcyclists was ranked as a 4 or 5 for 62 percent of dealers.

When it comes to their partners, dealers said BRP and Honda should earn the MVP award for 2016, with each getting 11 percent of the vote. Coming in closely behind with 10 percent each were Kawasaki, Polaris and Yamaha. Harley-Davidson earned 5 percent of the vote. BMW and Ducati each had 3 percent of dealers voting them MVPs.

Western Power Sports (WPS) took a commanding lead in the PG&A distributor MVP vote, with 35 percent. Parts Unlimited/Drag Specialties and Tucker Rocky tied with 21 percent of the vote each.

See dealer comments on their biggest concerns for 2017 and what they’re most optimistic about going into this year:

What is your biggest concern heading into 2017?

• “Consumer confidence with the political chaos that might happen.”

• “Electronic marketing need for consumer. Youth addictions to cell phones and social media. Guarded optimism. Zinger from the president.”

• “Uncertainty with government change.”

• “General lack of consumer confidence and flagging enthusiasm for powersports products.”

• “People, especially young people, don’t care.”

• “Our customers are getting very old.”

• “We are an Arctic Cat dealer, and the factory is struggling with everything from delivery quality, up to date product, as well as their image is tarnished.”

• “Cold winter to start the new selling season.”

• “Government regulations.”

• “Buyers with good credit.”

• “Less and less people seem to be riding motorcycles.”

• “Consumer confidence.”

• “The younger (40 and under) generation has left our older generation’s (50 and above) way of life.”

• “Motorcycles/ATVs seem to be ‘invisible’ as a market to the consumers under age 50. Motorcycle companies need to work together to promote motorcycles to the U.S. consumers.”

• “Japanese OEs need to get better product in the two-wheel business. They lack the ability to make a product that attracts Gen Y customers.”

• “Getting customers back to work.”

• “Farm economy.”

• “Economic changes and conditions, and internet sales.”

• “Too many competing dollars in my market area.”

• “Government regulations, being scared to want to even grow and take risk.”

• “Dealer profitability — due to extreme price discounting by several major Polaris dealers and eroding pricing in the G&A.”

• “Exposure to potential qualified customers.”

• “Continued hype of the new administration.”

• “Dealers selling into holdback, a problem that gets worse every year.”

• “Trying to keep the OEM from overloading me with inventory and trying to maintain a fair profit margin on what I sell.”

• “Keeping qualified people.”

• “Arctic Cat trying to overload me and put me out of business.”

• “Trying to get out of business with Arctic Cat.”

• “Not having enough interested consumers in the product in the first place.”

• “OEM leadership, the economy, engaging more people to ride.”

• “Getting younger buyers.”

• “Expense control, i.e. health care, salaries, etc.”

• “King Donny is going to do 3 things: 1. Raise the price of fuel; 2. Raise mortgage rates; 3. Start a war.”

• “Is this side of my business even worth bothering? It has become nothing but a cutthroat business.”

What makes you optimistic about the future of owning a powersports dealership?

• “After 67 years, it always comes back.”

• “We sell fun, and everybody wants to have fun.”

• “Changing trends in human transportation and the Internet of Things making riding safer.”

• “Consumers still need recreation in their life.”

• “Potential for young buyers, if government does not get in the middle.”

• “As more dealers go out of business, we keep rising to the top.”

• “With the possibility of economic conditions making a turn, we could be on the bottom starting up.”

• “The hope that more dealers will become better at their businesses and improve the customer experience thus increasing our opportunities.”

• “After decades of climb, we have finally seen the beginning of typical rise then fall then rise trend, and I believe after another series of recession-type years resulting in fall, we may begin to climb again.”

• “New president and drain the swamp of government people that haven’t a clue of running a small business.”

• “That customer service that just doesn’t mean cheapest is coming back and will separate the good from the bad.”

• “Trump, baby!”

• “I am not optimistic as long as the OEMs continue the way they treat their dealers. We are forced to take to much inventory; we are forced to do it their way with no input from the dealer. It is a joke on the amount of money I make on a lot of equip ment we sell. Risk is not worth the reward. Forty-one years being in this industry and seeing a lot of changes that are not good for this powersports market.”

• “Husqvarna and snow bike kits.”

• “That’s a tough one. It’s sometimes a challenge to be optimistic, when you see increases in revenue, but decreases in profit due to increases in personnel. I am hopeful that we will see an increase in interest for our Honda motorcycles and continue the uptick in ATV sales and dual sport models. We love what we do and hope to be able to spread our enthusiasm to others and help them become loyal customers!”

• “Nothing — very bleak outlook with less and less younger buyers. We are competing with electronics.”

• “I’m starting to see younger riders, but it won’t be for another 10 years or so before they are a force in the market.”

• “I enjoy it, and I have two generations coming after me.”

• “Innovation and diversity available in this market. Seems to be a lot of potential still left to tap into.”

• “This is an interesting question. We have awesome innovative products that are fun and cool, but we as an industry have to figure out how to get families involved with our products. In our area, boating is a huge past time. The nice thing about boating is it promotes families together, so does the RV industry. I think this would help us greatly in our industry.”

• “I feel that people need to have a hobby that gets them away from reality, Powersports does that better than any other recreational activity.”

• “Traffic getting more congested; HOV lanes becoming more popular and motorcycle friendly.”

• “People still enthused despite current government regulations.”

• “A new president, lower taxes and more employment opportunities.”

• “Interest by younger people.”

• “I’m not. Winters aren’t what they were, and most folks won’t spend $12k or more for a sled.”

• “For the near future, the hopes that President Trump can ease regulations for the industry and hopefully ease restrictions of areas for the off-road market.”

• “I think our economy is poised for some strong growth in the next four and maybe eight years. If this is the case, what we learned going through the last eight years will make us very profitable.”