Wells Fargo Securities begins coverage of BRP stock

Wells Fargo Securities has initiated coverage of BRP’s stock with an “outperform” rating, according to a research note provided to Powersports Business by Wells Fargo Securities analyst Tim Conder.

“We believe that BRP is positioned to gain share within the powersports industry recovery, driven by (1) operational excellence, (2) optimizing U.S. dealer coverage, (3) enhancing dealer/consumer touch-points, (4) the filling in of product whitespaces, and (5) acceleration of international sales,” Conder reports.

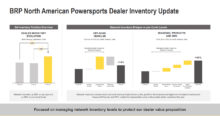

Conder goes on to write that the “powersports industry appears well positioned for continued recovery, given (1) improving economic metrics, (2) clean channel inventory, and (3) new/used market dynamics all lifting new unit sales. Macro pressures appear to be subsiding, with credit availability, economic momentum, and confidence levels strengthening consumer propensity to spend. Overall, BRP company fundamentals remain positive, with earnings quality, balance sheet strength, and cash flow generation yielding attractive valuation multiples.

“BRP is set to leverage additional growth opportunities by (1) advancing new and existing product categories, (2) promoting uptake of early-stage segments (SxSs, Roadster), and (3) optimizing dealer coverage/performance, with emphasis on North America. Aligning these initiatives should attract new users to the sport, boost purchase conversion, and stimulate cross-ownership. BRP carries a proven track record for innovation that garners valuable brand equity and market-share momentum. Note that FQ1 should be affected by (1) PWC hull production difficulties in Mexico, (2) transfer of PAC distribution to a third-party, (3) launch expense for Spark/Evinrude, (4) the longer winter season, and (5) Russian exposure.”