UTV P&A sales as part of new units rising

ADP Lightspeed data shows accessory sales with new units rise 6% in 2012

An exclusive study by ADP Lightspeed for Powersports Business readers shows that accessory sales that accompany new side-by-side purchases bring abundant opportunities for dealership growth.

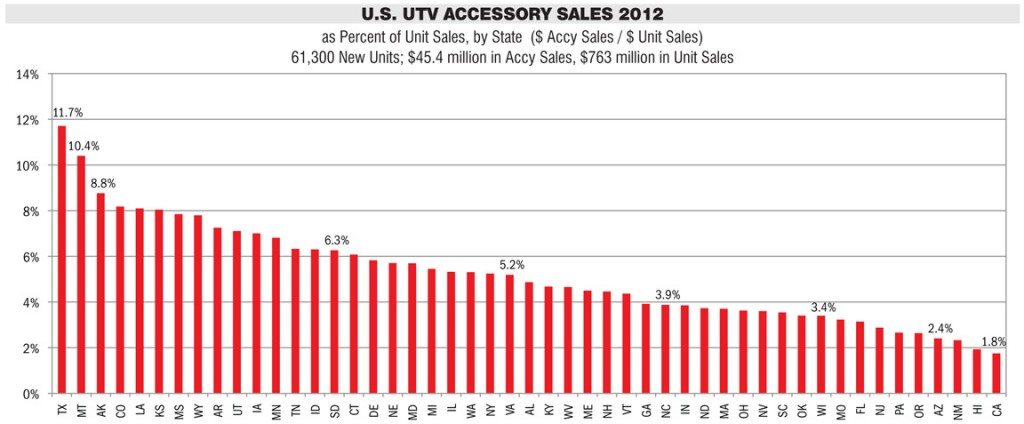

According to the ADP Lightspeed study of data from 812 U.S. dealers, Texas dealers in 2012 led all states in UTV accessory sales as a percent of unit sales. The study includes sales of 61,300 new UTVs in 2012. The dollar amounts are $45.4 million in accessory sales and $763 million in unit sales for 2012.

The rate of accessory sales on new UTV units has risen from 5.6 percent in 2011 to 6 percent in 2012. The five states with the highest penetration have increased from 9.7 percent to 10.5 percent. States with the lowest penetration have also gained, rising from 2.0 percent to 2.1 percent. These numbers reflect the sale of accessories on new UTV units expressed as a percent of the new unit selling price.

Texas took the top spot in U.S. sales in 2012 with 11.7 percent, or $11.70 in accessories for each $100 in unit sales. Montana, Alaska, Colorado and Louisiana rounded out the top five, with an average of 10.5 percent among them. With some small shifting of rankings, these same five states each appeared in the 2011 top five.

Hawaii was ranked lowest of all states in 2011 for UTV accessory sales, at $0.20 per $100. In 2012, Hawaii rises to 1.9 percent, or $1.93 per $100, according to the ADP Lightspeed study. The lowest five states averaged 2 percent in 2011, but rise to an average of2.1 percent in 2012. All states in the bottom five for 2011 remain in that group, with the exception of Missouri, which has been replaced there by Oregon.

Canadian dealers remain much as they were in 2011. The average that year was 7.2 percent, and in 2012 it drops slightly to 6.9 percent. A total of 2,632 units were analyzed in the study, and the $39.6 million in unit sales yielded $2.7 million in accessory sales.

“Interestingly, I find that about half of all units sold do not have accessories attached to the deal,” said Hal Ethington, who prepared the study for ADP Lightspeed’s Data Services division. “Looking at only those units that do have accessories on the deal, all rates of penetration stated above would be about double. Both measures — percent of units with accessories, and accessory dollars per unit when accessories are present — should be taken into consideration when judging UTV accessory sales penetration.”

Profitable accessory sales penetration

“It is apparent that levels of accessory penetration at 8 percent or higher are attainable. Second, we see that the median rate is around 5 percent,” Ethington said. “Dealers with rates below 5 percent should take steps to make product available, show it, and educate their sales force on features and benefits.

Ethington notes that the five states at the bottom of the list — California, Hawaii, New Mexico, Arizona and Oregon — may have geographic or economic reasons for their lack of sales, but determining those influences is difficult.

“This is not about the sale of UTVs — that is a given in all parts of the county,” he said. “Rather, this is focused on the sale of accessories along with the new UTV unit. Logic says that if the units are selling, there should be no reason that the accessories are not selling — in some measure. Granted, cold weather moves cabs and windshields, but note that the largest selling accessory is a winch, which has nothing to do with cold weather.”

Ethington credits the 2013 UTV market for bringing new life to powersports dealerships, much like the three-wheel Honda ATC 90 did in the early 1970s.

“We don’t really want to go back there, but the lessons learned there about introducing a new product type are useful now, 40 years later,” he said. “And, this report shows that some dealers have fully embraced this new market, and some have not. UTV accessories are readily available to the consumer from many sources. Dealers would do well to fully engage this market, and have a wide range of product available to demonstrate and sell. If you don’t know where to start, you may want to take a quick trip to Texas. At double the national norm, they are leading the way.”