BRP announces FY 2022 quarterly earnings

BRP has reported its financial results for the three- and six-month periods ended July 31, 2021.

“We delivered another record quarter, with revenues up 54% and Normalized Earnings per share up 154%. These excellent results are fueled by continued strong demand, market share gains, traction with new entrants as well as our teams’ ability to manage through a challenging supply chain environment,” said José Boisjoli, BRP President and CEO. “Looking ahead, we are optimistic about the future considering continued strong demand for our products, our new and exciting product introductions and additional capacity coming online over the next few months. Based on this positive outlook and factoring in ongoing supply chain and logistics challenges we are increasing our overall guidance for Fiscal 22. Normalized EPS is now expected to grow between 53% and 81% over last year. Furthermore, we are well-positioned to build on this momentum and generate further growth in Fiscal 23 primarily driven by sustained consumer interest in powersports and the upcoming significant inventory replenishment cycle.”

Below are details from the official announcement:

Outlook

Heading into the second half of the year, the Company remains focused on delivering its strong dealer orders for the year while managing through supply chain constraints which are expected to weigh more on product deliveries in Q3.

The Company anticipates the supply chain situation to improve as the year progresses and provide more upside in Q4, expecting Normalized EPS – diluted growth of about 40% for the quarter, reflecting the mid-point of its guidance range.

The Company expects to be well-positioned to build on FY22 momentum and generate further growth in Fiscal 23 primarily driven by the sustained consumer interest in powersports, added production capacity, demand for new product introductions and the upcoming significant inventory replenishment cycle.

Revenues

Revenues increased by $670.5 million, or 54.4%, to $1,903.8 million for the three-month period ended July 31, 2021, compared to the $1,233.3 million for the corresponding period ended July 31, 2020. The revenue increase was primarily due to a higher wholesale of Year-Round Products and Seasonal Products due to COVID-19 impact last year, lower sales programs due to a strong retail environment and a higher volume of Powersports PA&A, partially offset by an unfavorable foreign exchange rate variation of $100 million.

• Year-Round Products (50% of Q2-22 revenues): Revenues from Year-Round Products increased by $334.4 million, or 53.8%, to $955.6 million for the three-month period ended July 31, 2021, compared to the $621.2 million for the corresponding period ended July 31, 2020. The increase was primarily attributable to a higher volume of products sold due to COVID-19 impact last year, lower sales programs due to a strong retail environment and a favorable product mix of SSV sold. The increase was partially offset by an unfavorable foreign exchange rate variation of $51 million.

• Seasonal Products (30% of Q2-22 revenues): Revenues from Seasonal Products increased by $251.8 million, or 78.0%, to $574.5 million for the three-month period ended July 31, 2021, compared to the $322.7 million for the corresponding period ended July 31, 2020. The increase resulted primarily from a higher volume of PWC sold due to COVID-19 impact last year, lower sales programs in light of a strong retail environment and a favourable product mix of PWC sold. The increase was partially offset by an unfavourable foreign exchange rate variation of $29 million.

• Powersports PA&A and OEM Engines (13% of Q2-22 revenues): Revenues from Powersports PA&A and OEM Engines increased by $39.6 million, or 18.9%, to $248.7 million for the three-month period ended July 31, 2021, compared to the $209.1 million for the corresponding period ended July 31, 2020. The increase was mainly attributable to a higher volume of PA&A and lower sales programs in light of a strong retail environment, increased usage of vehicles by consumers and the COVID-19 impact last year. The increase was partially offset by an unfavorable foreign exchange rate variation of $15 million.

• Marinen(7% of Q2-22 revenues): Revenues from the Marine segment increased by $47.8 million, or 59.0%, to $128.8 million for the three-month period ended July 31, 2021, compared to $81.0 million for the corresponding period ended July 31, 2020. The increase was mainly due to the strong product mix in boats and lower sales programs, partially offset by the wind-down of the Evinrude outboard engines production resulting in a lower volume of outboard engines sold and an unfavorable foreign exchange rate variation of $6 million.

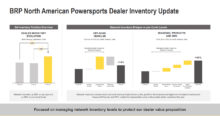

North American Retail Sales

The Company’s North American retail sales for powersports vehicles decreased by 19% for the three-month period ended July 31, 2021 compared to the three-month period ended July 31, 2020. The decrease in both Powersports and Marine segments was mainly driven by limited product availability.

• Year-Round Products: retail sales decreased on a percentage basis in the mid-twenties range compared to the three-month period ended July 31, 2020.

• Seasonal Products: retail sales decreased on a percentage basis by high single-digits compared to the three-month period ended July 31, 2020.

• Marine: boat retail sales decreased by 16% compared with the three-month period ended July 31, 2020.

Gross profit

Gross profit increased by $321.7 million, or 129.5%, to $570.1 million for the three-month period ended July 31, 2021, compared to the $248.4 million for the corresponding period ended July 31, 2020. The gross profit increase includes an unfavorable foreign exchange rate variation of $43 million. Gross profit margin percentage increased by 980 basis points to 29.9% from 20.1% for the three-month period ended July 31, 2020. The increase was attributable to a higher volume of Year-Round and Seasonal Products sold and a favorable product mix combined with lower sales programs driven by the strong retail environment and limited product availability. The increase was partially offset by higher logistics, commodities and labor costs due to inefficiencies related to supply chain disruptions and an unfavorable foreign exchange rate variation.

Operating expenses

Operating expenses increased by $42.8 million, or 22.7%, to $231.7 million for the three-month period ended July 31, 2021, compared to the $188.9 million for the three-month period ended July 31, 2020. This increase was mainly attributable to lower expenses in Fiscal 2021 following cost reduction initiatives to mitigate the impact of COVID-19.