Q3 gives dealerships a tough time

Majority of those surveyed were below plan

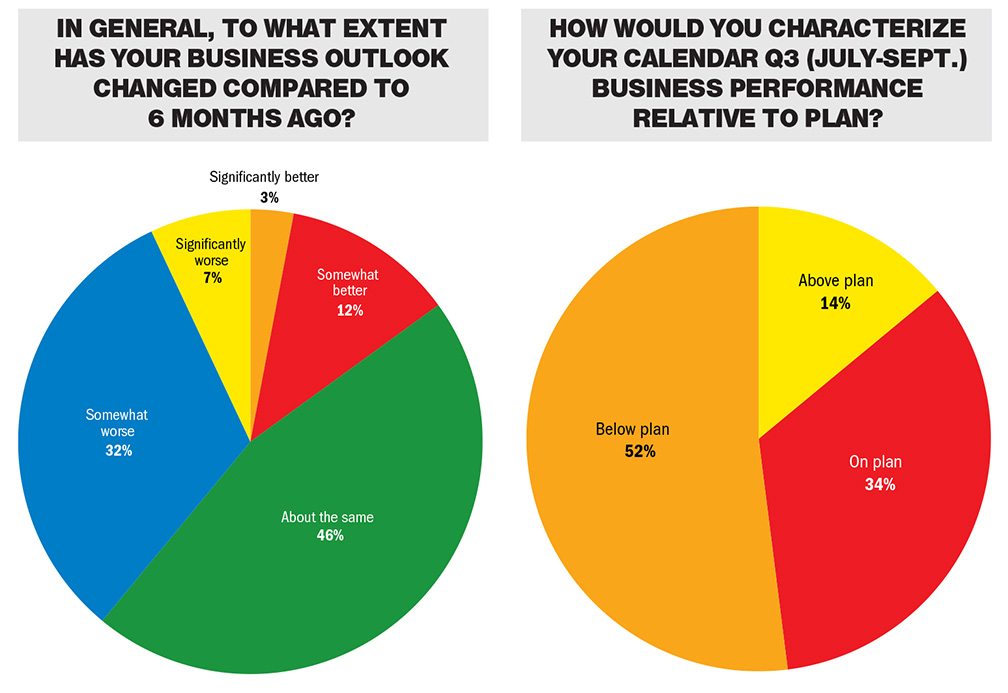

The third quarter of 2016 found dealers working harder than before to maintain last year’s numbers. According to a Powersports Business/BMO Capital Markets Q3 dealer survey, the majority of dealers were below plan. Of the 125 dealers surveyed from 41 U.S. states and five Canadian provinces, 52 percent marked below plan, and 34 percent said they were on plan. Only 14 percent of those dealers surveyed found themselves above plan in Q3.

Overall, 42 percent of dealers thought that business conditions in the industry were average, while 24 percent felt it was poor. The 2016 election climate, decreased customer interest and weather were among the top three external factors that dealers said contributed to their dealership’s below-plan performance.

“From the start, our oil and gas industry took a plunge last year, which has kind of started the year off at a decrease, which has continued into Q3,” said Kip Niles, owner of Arlington Motorsports in Arlington, Texas. “It has since stabilized, but the numbers still aren’t coming back. As we approach this election, we’re guessing that’s what’s causing that.”

Niles explained that although the weather initially posed a challenge to business, it seems that the political climate has influenced customers’ want to buy. In fact, 76 percent of the dealers surveyed said that they were most concerned about the U.S. political environment, up 3 percent from last quarter. Also, and additional 30 percent were worried about economic or political issues outside of the U.S.

Evan Bell, owner of Irv Seaver Motorcycles in Orange, California, also believes politics has had a hand in consumer demand: “Mostly I think the political environment has got our customers holding off on doing anything. We’re just not getting as many people walking through the door that are interested in buying motorcycles at this point,” he added.

Despite the concerns that Q3 has placed on dealers’ minds, many dealers are looking forward to growth in Q4. Bell said although Q3 found his dealership below its performance plan, that isn’t out of the usual for this time of year. “It’s our slower quarter because our sales are slower around Christmas time,” he said. “The main thing is we’ll start getting some new product, something new and exciting for customers to look at.”

Emily Franklin, a manager at Ken’s Cycle Center in Highland Springs, Virginia, agreed that both politics and weather had an effect on overall performance. But Franklin remained hopeful that after the election, customers will return to normal spending. The dealership, while keeping an eye on its budget, plans to focus on advertising and incentives to carry over into Q4. “Hopefully we’ll get some creative advertising, aggressive sales and rebates going. We’re just trying to change things up and not do the same thing,” Franklin added.

Arlington Motorsports has also made a commitment to upping its advertising, favoring social media and in-house events over more costly alternatives. “We’re doing a lot more social media,” said Niles. “We have to be careful with what we’re spending because our budget is very tight. We’re not selling as many, so we’re not getting as much co-op, and the manfacturers on top of that have cut the co-op back.”

With new product arriving in Q4, more dealers are hopeful that will lead to increased sales and better performance. Current inventory levels were initially steep with some dealers, resulting in early incentives from manufactures to try and move product.

Of those surveyed, 37 percent of dealers said inventory was overall too high, with 60 stating it was about right. Fifty-three percent of dealers found heavyweight motorcycle inventory too high, and 52 percent said the same about snowmobile stock.

Dealers who carry Polaris were asked if they believed the recent recalls from the OEM would have an adverse impact on the brand and future sales — 72 percent said yes, and 28 percent thought it would not have a negative effect.

Niles added, “We need more aggressive support from financing, especially from the manufacturers. The manufacturers are pushing the dealers to take more product and if the manufacturer really wants to sell more products, they need to get more into the game.

“It’s a declining business, so that just makes it a tougher game. About every quarter now we have to figure out where our customer is at, what has changed and what we need to do and focus on how we’re going to attract them and keep them interested.”