Survey shows F&I business mostly level

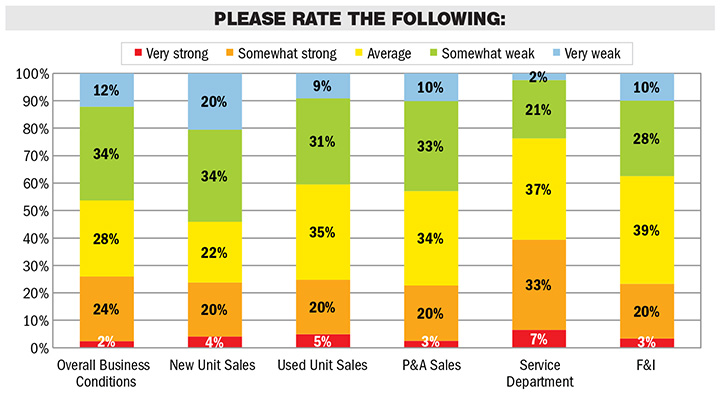

About 2 of 3 dealers call F&I average or somewhat strong

The Powersports Business/RBC Capital Markets Q4 survey of 123 dealers from 42 states and Canada representing 49 OEM brands showed that business in the F&I department has trended toward the average-or-under side of the ledger.

About 39 percent of respondents said F&I business was “average,” with 28 percent declaring the revenue stream as “somewhat weak,” and another 10 percent saying F&I was “very weak” in the fourth quarter compared to the year-ago quarter.

Some 20 percent of dealers said their F&I department was “somewhat strong” in Q4, while only 3 percent declared F&I “very strong” in the quarter.

Those sentiments correspond to the following responses from the Q4 2014 survey, which included 139 dealers from 40 states and Canada:

• Very strong: 2 percent

• Somewhat strong: 21 percent

• Average: 46 percent

• Somewhat weak: 21 percent

• Very weak: 12 percent

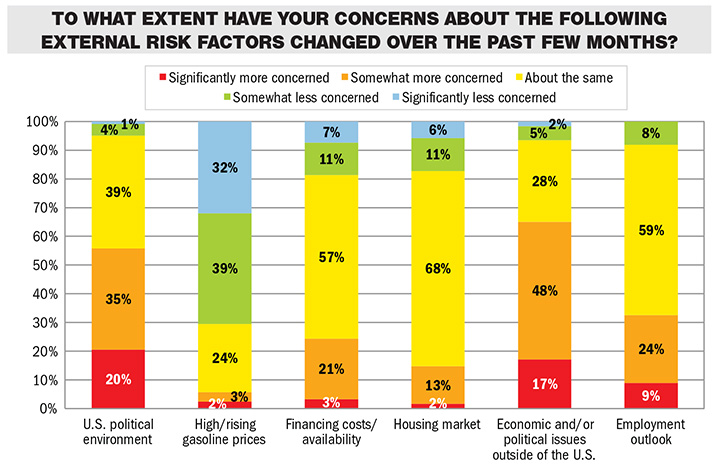

Looking at the Q4 2015 survey, one of the questions asked: “To what extent have your concerns about the following external risk factors changed over the past few months?” In regards to “Financing costs/availability,” 57 percent of respondents said their concerns were “about the same,” with an additional 21 percent at “somewhat more concerned.” About 11 percent were “somewhat less concerned,” and 7 percent were “significantly less concerned.” Only 3 percent were “significantly more concerned” with financing costs/availability in Q4 2015.

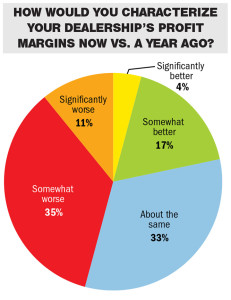

Also, 46 percent of respondents noted that profit margins in Q4 2015 were “somewhat worse” or “significantly worse” than in Q4 2014. One in three dealers said profit margins were “about the same” as the year-ago quarter, with 17 percent saying dealership profit margins were “somewhat better” than Q4 2014. Only 4 percent report profit margins as “significantly better” in Q4 2015 compared to Q4 2014.