Dealers learn winter is not coming

Low snowfall affects Q4 sales

As always, weather remained the main contributing factor in snow sales this past quarter. Most snowmobile dealers who participated in the Q4 2015 Powersports Business/RBC Capital Markets Dealer Survey said they had a less than favorable quarter in comparison to Q4 2014.

A warmer winter and extremely low amount of snowfall found two-thirds of snowmobile dealers’ year-over-year sales down in Q4, with 48 percent saying they were down 20 percent or more. Only 22 percent of snowmobile dealers had increased sales in the fourth quarter.

Karen Shaw, owner of Belleville, Ontario-based Belleville Sport & Lawn Centre, said weather is definitely the most prominent factor in determining snowmobile sales. “I’m pretty south in Ontario, and we’ve only had like 2 inches. Compared to the last two years where we’ve had snow, there’s really not much,” she said. Even if snow isn’t as heavy as prior years, Shaw said the dealership’s proximity to the Bay of Quinte usually means business from local ice fisherman, but not this year: “There’s no ice, and there’s not going to be any in the near future.

“That being said, I sold two more sleds this week, but it’s the avid buyer that’s purchasing, not so much the spontaneous buying. We may still get snow yet, but for us, if you don’t have it before Christmas, that’s the impact right there of whether or not you have a good year,” Shaw said.

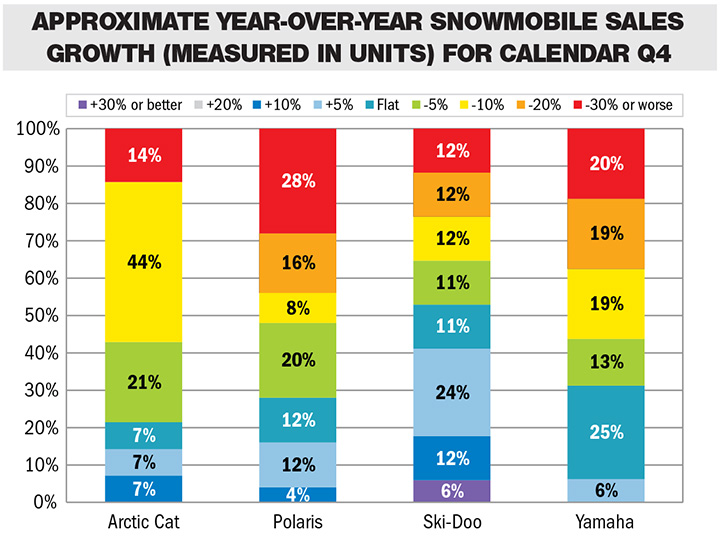

By brand, 58 percent of Arctic Cat dealers reported their year-over-year sales were down 10 percent or more. Twenty-eight percent of Polaris dealers were down 30 percent or more. One-quarter of Yamaha dealers were flat in year-over-year unit sales, while 42 percent of Ski-Doo dealers were up 5 percent or more.

Snowmobile inventories are understandably up, as a result of such low units sales. In fact, 85 percent of snowmobile dealers report their sled inventory is too heavy. Because of their inventory levels, 54 percent of snowmobile dealers are very concerned about carryover sled inventory, however 37 percent are not concerned.

“In my opinion, the manufacturer shouldn’t even make 2017 models; they should just skip ’17, and we’ll just keep selling the ‘16s because they’re all going to be left over,” said Bob Weaver, owner of Bob Weaver Motorsports & Marine, a multi-line dealership in North Tonawanda, N.Y. The store has seen a large decrease in door swings and customer interest in snowmobiles as a result of the warmer weather.

As snowmobile dealers look into the discounting environment in relation to the 2015-16 selling season, 54 percent say that the amount of discounting is significantly or somewhat greater than expected.

“I’ve been a snowmobile dealer for 45 years; by far this has been the worst weather we’ve ever faced,” said Weaver. “The manufacturers have come out with rebates, but you have to have the need before there’s going to be a want. With no snow, you could make the snowmobiles 50 percent off, and you couldn’t sell them — you have to have snow.”

Reno Cycles & Gear, a Nevada-based dealership that sells Polaris snowmobiles, was above plan for Q4 and was up 5 percent in snowmobile sales, but expects to have no sales growth in 2016.

Bill Hermant, Reno Cycles’ owner, said that while sales for now are good, heavy inventory provided by Polaris after its yearly snowmobile meeting may cause problems in the future. “Polaris has a tendency to overload the dealers,” Hermant said. “They are doing a good job of discounting, but in the snowmobile industry, snowmobiles are a commodity. You just give them away and hopefully sell the oil and the clothing. If you sell a $15,000 sled, you make $250.”

While 13 percent of snowmobile dealers project a sales increase in the next 12 months, 80 percent believe their sled sales will decrease. Outlook among brands was most favorable with Yamaha dealers, half of whom believe they will experience flat to a 5 percent increase in sales. Twenty-nine percent of Arctic Cat dealers reported they expect a flat year, and 21 percent forecast a 5 percent decrease in 2016. Seventeen percent of Polaris dealers expect any growth over the next 12 months, and 60 percent of Ski-Doo dealers surveyed think they will be down 10 percent or more.