Dealer sentiment takes drastic turn for worse

Inventory levels, store traffic are cause for concern

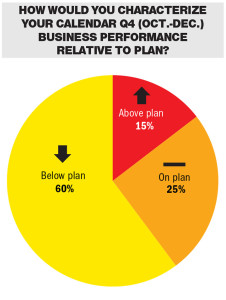

The fourth quarter of 2015 was not a positive one for many dealers, the quarterly Powersports Business/RBC Capital Markets survey found. Of the 123 dealers from 42 U.S. states and Canada who participated in the survey, 60 percent reported their Q4 performance was below plan.

One-quarter of the dealers were on plan for Q4, and only 15 percent were above plan.

When rating overall business conditions for the quarter, 34 percent said they were somewhat weak, while 12 percent reported they were very weak. New units struggled especially, with 54 percent of dealers saying their new unit sales were somewhat or very weak in the quarter.

Another 43 percent saw somewhat or very weak P&A sales, and 40 reported pre-owned unit sales were somewhat or very weak.

Customer traffic played heavily into the lack of sales, as 38 percent of dealers said Q4 2015 traffic was somewhat worse than it was in the fourth quarter of 2014. Another 15 percent reported it was significantly worse than the year-ago quarter. Buying interest was somewhat worse at 37 percent of dealerships, while it was significantly worse than Q4 2014 for 18 percent of dealers.

Profit margins aren’t helping dealers, either. Thirty-five percent said profit margins were somewhat worse in the 2015 fourth quarter than they were a year ago. And 11 percent reported margins were significantly worse.

Not surprisingly with warmer than usual weather in much of the country and low snowfall amounts, snowmobile dealers have seen the largest decreases. Two-thirds reported their year-over-year sales were down in Q4.

Also struggling during the last three months of the year were sport bike, heavyweight motorcycle and scooter sales. Fifty-seven percent of sport bike dealers saw those units drop 5 percent or more in the quarter, while 56 percent of heavyweight motorcycle dealers reported the same. Half of the scooter dealers who participated in the survey saw scooter sales drop 5 percent or more. The only group of dealers where more were up than down were side-by-side dealers, of which 49 percent reported Q4 sales were up 5 percent or more.

With snowmobile unit sales down, inventories are up. Eighty-five percent of snowmobile dealers report their sled inventory is too heavy. Heavyweight motorcycle dealers were almost all split between having too much or about right amount of inventory of those units, with 46 percent saying they have too much, and 53 reporting inventory is about right. While 53 percent of side-by-side dealers reported inventory is about right, 40 percent said it’s too heavy.

The rough quarter has disheartened many dealers. Fifty-four percent of dealers polled said their business outlook has become somewhat or significantly worse when compared to the past six months.

However, many are optimistic about the next 12 months in a variety of segments. Fifty-seven percent of side-by-side dealers expect those unit sales to grow by 5 percent or more in the next year.

Of the heavyweight motorcycle dealers, 41 percent expect an increase in 2016, while 29 think they’ll be flat. Close to one-third of ATV, PWC, sport bike and off-road bike dealers expect those sales will increase this year.

Not surprisingly, 80 percent of snowmobile dealers expect their sled sales will decrease in 2016.

The following are anonymous comments left by dealers about their quarterly performance:

• “Slowly crawling back except snowmobiles.”

• “Saw a slight increase in interest this fall, but most of those looking had credit scores that couldn’t be financed without kicking back almost half of the profits.”

• “I think the market is in a good place here in our area. Excited with the future. Hoping that the manufacturers can continue to introduce exciting product and new segments for growth.”

• “Lack of snowfall is hurtful!”

• “Traffic is very low; inventory and pricing are too high. [Capital] One is a serious concern. Not looking good.”

• “Starting point for new bike sales is $1k below MSRP. Good for consumers, bad for dealers. If we could only agree to compete based on everything but price, we’d all get enough business, and margins would be vastly improved. But that’s collusion, so we know that we must start at $1k below and make up missing dollars/margin elsewhere. It’s best that we simply forget all years before 2008 even existed. Looking back on dealership performance pre-financial meltdown has zero relevance today.”

• “I see a slight glimmer of hope for motorcycle sales in 2016. Unfortunately, most companies are trying to offer price incentives instead of using fun, adventure, freedom or other emotional reasons for owning a motorcycle.”

• “There are too many players in the heavyweight/cruiser segment.”

• “OEMs need to reduce dealer inventory instead of forcing dealers to order more than they need just to qualify for rebates and promotions.”

• “We are in a pre-election holding pattern. I do not see much, if any growth next year. For us to see growth, it is going to take a large push from the OEMs. We are preparing for a flat year ahead. No new hires and may reduce staffing levels by 5-10 percent early in Q1.

For more survey charts, see the digital edition of this issue by clicking here.