Prepaid maintenance growing F&I sales

ADP Lightspeed study shows service contracts remain driving force in F&I dept.

An ADP Lightspeed study provided exclusively to Powersports Business shows that prepaid maintenance has added tremendous growth to F&I department revenue stream over the past four years.

In the study of F&I products sold with V-twin and metric motorcycle unit sales by ADP Lightspeed subscribers, the data provides insight into how the most effective dealerships are employing F&I products with their unit sales.

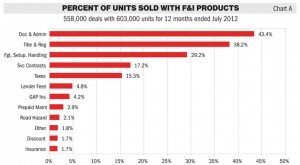

The analysis, which included more than 600,000 unit sales from the 12 months ended July 2012, finds that documentation and administrative fees are the charge most often added to a motorcycle deal. They are included in 43 percent of all deals.

As shown in Chart A, the rate of penetration by F&I products is expressed as the percent of units that carried a sale of the product. Following doc fees and administrative charges, title and registration were next at 38 percent, followed by freight, setup and handling charges on 29 percent of deals.

Service contracts were sold on 17 percent of units. GAP insurance was seen 4.2 percent of the time, prepaid maintenance was present on 2.9 percent of units, and parts (not sold through the service department on a repair order) were listed on 1.4 percent of units.

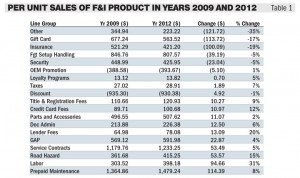

From 2009-12, the greatest increase by any F&I product in average dollars per unit sold is prepaid maintenance, which has increased $1,365 to $1,479 per unit sold.

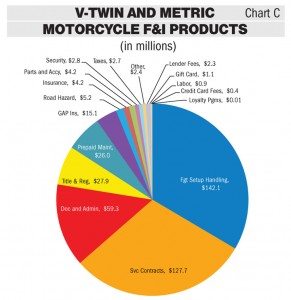

If freight and setup charges are included with F&I products, they account for the largest portion of F&I sales to units. Freight and setup charges generated $142 million in sales in the 12 months ended July 2012. Service contracts were next in revenue, with $128 million in sales.

“F&I products were grouped into 19 major types and compared for the years 2009 and 2012,” ADP Lightspeed senior analyst Hal Ethington said. “During this three-year span, there was little variance in ranking of penetration, but dollars per unit sold did change considerably.”

Revenue produced per unit changed considerably between the two years studied, as shown in Chart B. Prepaid maintenance rose $114 from 2009-12, the highest dollar increase of all F&I products. Road hazard, service contracts and GAP insurance all had substantial gains by 2012. Doc fees and credit card fees remained relatively stable, rising only slightly.

“Surprisingly, sales of security products (etching systems, LoJack, theft alarms, etc.) fell by over $23,” Ethington said.

Freight and setup also decreased by just less than $40. Large decreases were seen in insurances, gift cards and other miscellaneous products. Each of these groups fell by $100 or more per unit.

“Gift cards are a special case in this group,” Ethington said. “The amounts [in Table 1] are larger than would be expected for a normal ‘gift,’ due to the practice of some dealers to include pre-paid accessory sales as a gift card sale. The customer pays for accessories not yet delivered, the amount is financed on the deal, and the customer receives a gift card that can be used at the parts counter to pay for the accessories when picked up.”

Chart C analyzes the total revenue returned by each of the 17 groups when the per unit income is multiplied by the number of units affected. For the year ended July 2012, freight and setup returned $142 million in sales to the dealers. Service contracts are next in size with $228 million in sales. Doc fees account for $59 million; prepaid maintenance contributed $26 million.

“GAP insurance was barely part of the upper end of sales volume with $15 million, and surprisingly, road hazard products and insurances were present with $5 million in revenue,” Ethington noted.

All other groups combined accounted for about 10 percent of total F&I sales.

Ethington agrees that the study includes some products that are more “F&I” than others.

“Among the top generators, freight and setup would not technically be F&I,” he said. “Neither would parts and accessories or security products. These are actual hardware that have been added to the deal, but could as easily be classified as a parts sales.”

On the other hand, service contracts, doc fees, prepaid maintenance, GAP insurance and road hazard insurance all are traditional F&I products.

Ethington also said that contract interest participation, a normal F&I product that does produce significant revenue, has not been included in this study. Dealership reporting of this particular item varies widely, and it was not possible to gather reliable data in a uniform manner.

After pouring over another set of data that had been previously released, Ethington noted that service contracts are the driving force in generating F&I revenue.

“A 50 percent increase in credit card fees will mean little in the overall picture, and would be easily be offset by a less than one-half percent drop in service contract revenue,” Ethington said. “In fact, the irritation factor inherent in a charge for credit card use likely carries a greater risk of driving the customer away than does offering more expensive insurances that would actually have some potential benefit to the buyer. Dealers would be well advised to pay close attention to the proven heavy lifters of the F&I world: freight and setup, service contracts, doc fees and prepaid maintenance. Because of Internet shopping and resulting low unit margins, solid performance here will carry the department a long way toward the traditional goal of contributing a substantial portion of dealership profit.”