Trade-ins grow in popularity

Economy, dealer excitement for used appear to drive exchange

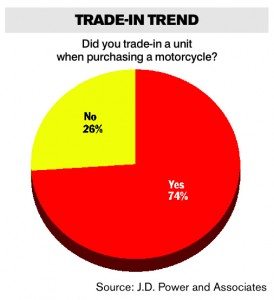

It became common practice this past year for customers to give up an old motorcycle before stepping into a new purchase, with nearly 75 percent of new bike buyers in 2011 reporting they traded in an old unit when buying their new ride.

Some dealers say they’ve seen this trend emerge in their own stores, and they believe the economy, retail financing changes, OEM pricing and dealer excitement for carrying pre-owned have all led to the turnover.

The trade-in trend appears to be a recent movement. In 2010, only 57 percent of riders reported that they traded in an old unit for their new one, and five years ago, only 39 percent reported the same, according to the 2011 J.D. Power and Associates Motorcycle Competitive Info Study. Powersports Business annually receives exclusive data from the only consumer survey of its kind by J.D. Power and Associates.

“In our area, we are one of the only franchised dealers who aggressively takes trades, as it fuels our pre-owned business, and we see an increase each year on the number of trade-ins we take,” reported Joey Belmont, general manager of Big #1 in Birmingham, Ala.

“In our area, we are one of the only franchised dealers who aggressively takes trades, as it fuels our pre-owned business, and we see an increase each year on the number of trade-ins we take,” reported Joey Belmont, general manager of Big #1 in Birmingham, Ala.

He and other dealers believe the down economy has played a big factor in riders being unable to hang on to an old motorcycle while still being able to afford a new one.

“In the past, greater discretionary income — or liberal financing — may have allowed buyers to have more than one bike at a time. If that was indeed true, it seems no longer to be the case,” said Curtis Sloan, general manager of Sloan’s Motorcycle & ATV in Murfreesboro, Tenn.

As the economy crumbled, financing changed, and once-accepted buyers are now being turned down for loans, preventing some new purchases. However, trade-ins often give buyers the opportunity to cut down on the amount loaned by using an old bike to supplement the purchase of a new one.

“As everyone knows, lenders tightened up dramatically in late ’08-’09; consequently, it has been and still is harder to get customers financed,” Belmont said. “Having a trade-in reduces the amount of money financed in the deal, and therefore, makes some deals easier to get bought.”

The economy has also affected MSRPs of many bikes, and customers are being drawn to value-priced models. Steve Reynolds, principal of Big Moose Harley-Davidson in Portland, Maine, has seen a lot of non-Harley riders trade in their motorcycles to upgrade to a less expensive version of their dream bike.

“The prices of Harley-Davidsons have come way down since the heydays. No selling for market value anymore, they’re selling for MSRP or lower,” he said. “I still think there’s a lot of people driving metric bikes out there that want a Harley, and probably in the past they’ve been too expensive for them.”

Another effect of the economy is, in general, a lot of people are operating with less money than they have in the past; therefore fewer can buy brand new bikes. Though this has been a hit on the industry, many dealers have taken notice, and the pre-owned market has boomed. More dealers are now encouraging customers to trade-in a motorcycle to increase their pre-owned inventory and encourage more sales in their stores.

“Pre-owned inventory sales are always far more profitable than any brand of new cycle or ATV,” Sloan explained. “A profitable store will generally have a sales ratio of one or two used vehicles for every one new vehicle.”

As part of the discovery process during a sale, the staff at Sloan’s Motorcycle & ATV will ask about trade opportunities. The dealership will then resell trades when possible and wholesale undesirable models quickly.

At Big Moose, trade-ins propelled the dealership’s pre-owned inventory for years, but as the pre-owned market grew, the store had to reach out to other sources to keep a strong inventory. Reynolds started seeking bikes at auction in the fall of 2010 just to keep the stock full. He keeps his showroom stocked with about 80 pre-owned bikes at all times.

“There’s still a good calling for used bikes,” he said.

Belmont’s dealership very actively seeks trade-ins, advertising wanted ads on its website and on any marketing material in which co-op policies allow. To handle all the pre-owned activity, the dealership has even hired a dedicated buyer.

“During the probe, our salespeople always ask if they have a vehicle they would like to trade in, and no matter what it is, they act excited at the prospect of getting it,” he said.

Nearly all — about 95 percent — of the trade-ins that come into Big #1 go straight into inventory; those few that aren’t expected to bring profit will go to auction. Belmont says that as the pre-owned market has spiked, more dealers are becoming educated about the market each year, and those who are succeeding in the market are realizing great profits.

“Trade-ins increase your sales — fact,” he said. “If you sell a new unit outright, you have one sale. If you take in a trade, you have the sale of the new vehicle, plus the future sale of the vehicle you have traded in. Also, with a large percentage of powersports customers ‘trading up’ within 18-24 months, your customer base and sales increase at a higher rate.”

The trade-in trend has driven pre-owned sales at his dealership and many others, and those who are taking advantage of increased pre-owned sales, such as Belmont, hope the trend continues.