Timing, location right for NPA Philly

Dealer-only auction expands to fifth location

Simply put, National Powersports Auctions’ expansion into the Philadelphia market was all about timing and location.

NPA executives had been considering a location in the northeastern U.S. for several years. And when the right facility in an ideal location became available, NPA was proud to go live in December at 2554 Ford Road in Bristol, Pennsylvania, accepting dealer consignments and repossessed vehicles.

The 35,000-square-foot facility will accommodate more than 500 units per month and will house meeting rooms, offices and condition report stations like the other NPA operations in San Diego, Dallas, Cincinnati and Atlanta. The new location is near the intersection of the 95 and 276 highways, 29 miles from the Philadelphia airport.

“After 26 years, five locations and nearly a million vehicles sold, this is an accomplishment we should all be proud of,” NPA founder and CEO Cliff Clifford said.

The first sale is scheduled for Jan. 11, and will be held the Wednesday before the Friday Dallas auction each month in 2017.

“We’ve had additional facilities on our radar screen for a number of years. For us it came down to where and when,” said Jim Woodruff, NPA’s chief operating officer. “Looking at the demographics, the northeast has always been very attractive. The density is terrific from a dealer and product perspective. We have a good core base of lender volume that we deal with in that area, and honestly the dealers in that part of the country have been hungry for NPA to get up there and bring our volume and processes to them.”

Bob Fitzpatrick, NPA’s newest GM and longtime industry professional, will oversee the latest dealer-only auction facility. Along with Fitzpatrick, NPA sales manager Dusty Krepp will be headquartered at the new Philly location.

Dealers who might have felt limited by their liquidation options due to the location of NPA’s other locations in Cincinnati and Atlanta now have an alternative in Philly.

“Some dealers in the Northeast have accumulated inventory they had a hard time liquidating. With the new location we have been able to decrease the time the inventory is not on their floor and the transportation costs,” Woodruff said. “I think the timing is perfect, particularly as dealers have gotten more sophisticated about turning inventory and trying to optimize the value both on the front end and back end.”

Dealers who might not have considered NPA in the past due to the lack of a location in the northeast are already becoming more familiar with the NPA Value Guide. In 2016 alone, more than 4,000 dealers performed 500,000 Value Guide lookups on both NPA’s website and mobile platform. Unit values are updated daily, with more than 26,000 models available for search. Units can be filtered by region, timeframe, mileage and condition. The Value Guide can protect the dealer from buying too high on trade-ins.

NPA also has moved its Dallas location. Now in a brand-new, stand-alone building at 900 Gerault Road in Flower Mound, the first auction at the new 140,000 square-foot facility is scheduled for Jan. 13. The new building is about 40 percent larger than the previous 107,000 square-foot space. It also has easy access from a major thoroughfare, and is closer to the Dallas-Fort Worth airport. The office space has doubled in size, including expanded training and meeting space. It’s also been optimized for unit flow and vehicle preparation, in addition to having plenty of parking and loading area.

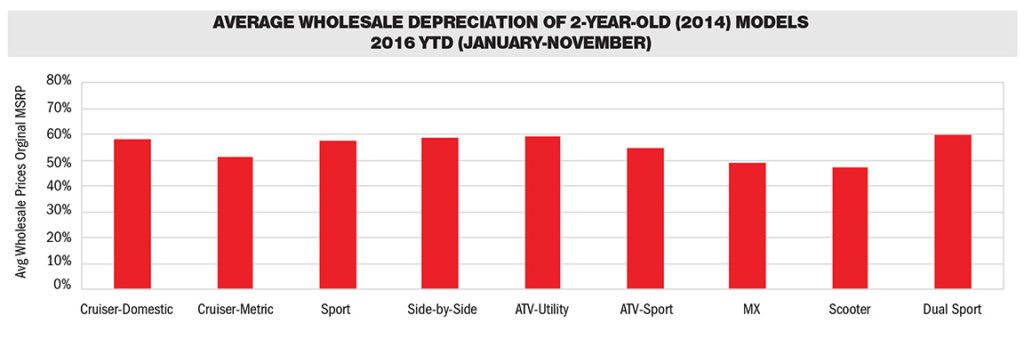

For dealers in the northeast new to NPA — as well as their longtime dealer customers throughout the U.S. — here’s a review of the NPA Average Wholesale Deprecation chart for two-year-old models (viewable in the Digital Edition, Page 10), provided exclusively to Powersports Business.

Domestic cruiser — Powersports vehicles have a distinct seasonality in their wholesale pricing. Generally, prices are stronger in the spring and softer in the late summer and fall as dealers’ appetite for inventory varies with riding seasons.

The seasonality for domestic cruisers is the most consistent over time. Average wholesale pricing in 2016 has averaged less than 2015 due to a slightly older and higher-mileage product mix. An uncharacteristic dip occurred in September, when a higher-than-normal mix of lower-MSRP units were sold. Otherwise, 2016 is a very typical year.

Metric cruiser — Metric cruiser wholesale price seasonality is also fairly consistent over time, but can be more variable month-to-month and more affected by product mix and the effect of summer rebates. Metric cruiser pricing in 2016 has been less seasonal than prior years, partly due to variations in product mix and partly due to more competitive retail pricing in the mid-spring. Early indications are that pricing in the upcoming months will be slightly higher than usual.

Sport bike — Wholesale price seasonality for sport bikes tends to be more influenced by market demand than product mix. It is also more heavily weighted to a spring retail market than other categories. 2016 has been a good year for sport bike pricing, which has seen similar seasonality to prior years and has the potential for stronger pricing in upcoming months.

ORV — Off-road vehicle wholesale pricing is the least seasonal of all, primarily because things like ATVs can be ridden year-round, be it for fun in the spring, farming in the summer or hunting or ranch work in the fall. Side-by-side pricing is the least seasonal of all, with 2016 showing strength throughout the year.

Further, NPA’s Value Guide Dealer Usage map (viewable in the Digital Edition, Page 11) shows dealers that use the NPA Value Guide by city.