Triple threat: Ducati’s PSI score tops again

Industry average rises by 2 points; now highest yet

Pied Piper Management Company LLC reached a new milestone in 2016 — it published its 10th annual motorcycle Prospect Satisfaction Index (PSI) that measures how dealerships treat motorcycle shoppers in a variety of sales process categories.

“We’ve had an interesting seat to observe what has happened in the motorcycle industry over the past 10 years. The motorcycle industry has improved dramatically; there’s no question about it,” said Fran O’Hagan, president of Pied Piper Management Company LLC. Pied Piper has measured the same categories for the past 10 years, focusing on 55 different sales criteria that break down how salespeople treat customers and sell their brands. Dealerships that were shopped in 2016 carried the following brands: Aprilia, BMW, Can-Am (Spyder), Ducati, Harley-Davidson, Honda, Husqvarna, Indian, Kawasaki, KTM, Moto Guzzi, MV Agusta, Polaris (Slingshot), Star, Suzuki, Triumph, Victory, Yamaha and Zero.

O’Hagan said there were three key behaviors that are twice as likely to happen today as they were 10 years ago. “The industry is twice as likely to offer test rides; they’re twice as likely to ask about trade-ins, and they’re twice as likely to ask for contact information to allow follow-up,” he said.

As a whole, the industry declined in a few areas of the sales process. In 2016, the study found that salespeople only offer printed items (pamphlets, write-ups, etc.) to shoppers 49 percent of the time, down from 67 percent in 2015.

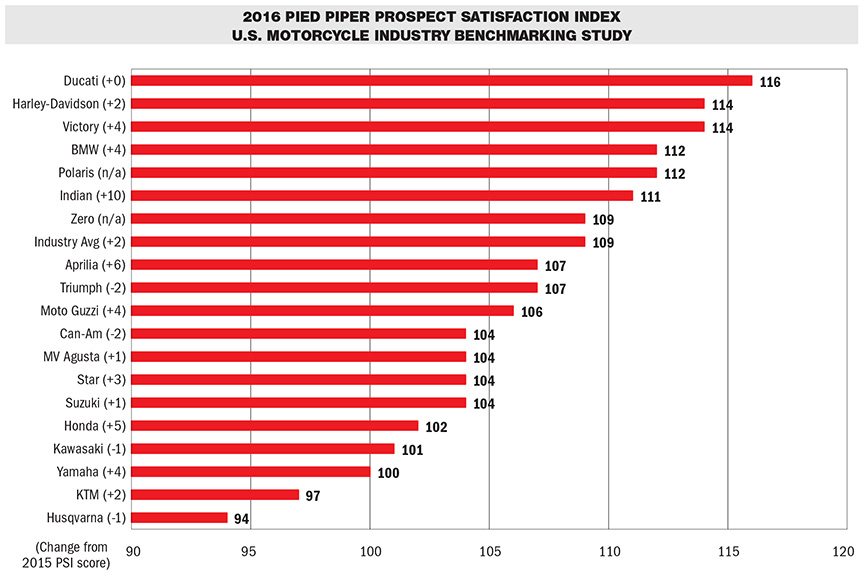

For the third year in a row, Ducati ranked No. 1 in PSI score with 116 points, the same number it had in 2015. Harley-Davidson and Victory dealerships tied for second place, each with 114 points, while BMW and Slingshot dealers tied for fourth with 112 points.

Of the 19 brands surveyed, 12 experienced increased scores from 2015. The greatest overall improvement was Indian, up 10 points from 2015 with a total of 111.

“Indian’s dealer body has grown dramatically,” O’Hagan said. “The composition of the dealers has changed. Also, there’s no question that Indian is Polaris, so the same attitude about the way dealers sell from Polaris, certainly would carry over to Indian.”

Harley-Davidson, Victory, BMW, Aprilia, Moto Guzzi, MV Agusta, Star, Suzuki, Honda, Yamaha and KTM also increased their scores from 2015. Brands with a decline in score from 2015 to 2016 included Husqvarna, Kawasaki, Can-Am and Triumph.

On a positive note, the industry average PSI score increased, up 2 points from 2015 to 109, which O’Hagan said is the highest average score Pied Piper has measured in the study’s 10 years.

“When we first started measuring the motorcycle industry back in 2007, we set the industry average mathematically to equal 100. This year there are only two brands that are below 100, KTM and Husqvarna,” O’Hagan said. “The norm for the industry has improved.”

O’Hagan said there has been a positive trend in the “ask for the sale” portion of the sales process between 2015 and 2016. “The biggest improvement centered on three sales steps: salesperson suggested sitting down at a desk, salesperson attempted to write up transaction and salesperson attempted to forward the sale,” O’Hagan said.

The percentage of the time when the “salesperson suggested sitting down at a desk” increased to 49 percent from 41 percent; “salesperson did anything at all to forward the sale” rose to 69 percent from 62 percent of the time; “salesperson mentioned availability of financing options” improved to 65 percent from 62 percent of the time. Also, the percentage of the time that the salesperson asked for the shopper’s contact information hit a record 59 percent, up 2 percent from 2015.

Each of the 55 sales criteria have different weightings, O’Hagan pointed out, which are not published, but it’s key to note that the industry portions that increased in percentage this year are important steps.

With the 2016 study, Pied Piper began tracking Polaris Slingshot dealers, who finished above industry average at 112.

“From the scores on our rankings, you can say maybe there’s some manufacturers who worry about other things, but the way that their dealers sell is something they don’t really focus on. That’s never been the case with Polaris,” said O’Hagan. “It doesn’t surprise me that Victory is up toward the top or that Slingshot, or Indian is up toward the top. I know that Polaris as an organization cares about the way their dealers sell, has opinions about it and shares those ideas through sales training.”

Compared to the rest of industry, O’Hagan said Polaris dealers were much more likely to offer a test ride. Salespeople industry-wide offered a test ride 31 percent of the time, while Slingshot dealers offered them 44 percent of the time. The same dealers gave compelling reasons to buy 49 percent of the time, compared to the industry’s 42 percent. Slingshot dealers, along with Harley-Davidson dealers, were also among the most likely to specifically ask the prospect to buy. Both brands were at 55 percent, tops in the industry.

Zero, the electric motorcycle brand, was also included on the PSI survey for the first time in 2016. The brand finished with a score of 109, the same as the industry average. O’Hagan says that finishing on the industry average, for a small company that’s only been producing bikes for 10 years, is a positive step. “The areas where Zero outperformed the industry: They were more likely to offer test rides, and more likely to mention maintenance programs and discuss features unique to the brand, which makes sense given their product,” he said.

Areas where Zero salespeople were likely to underperform compared to the industry included asking about trade-ins and asking for the sale.

The habits studied in the PSI surveys are positive ones for motorcycle dealerships. “It’s not subtle; it’s completely black and white. The dealers who focus on making sure that these behaviors are happening outperform the dealers who are not,” O’Hagan added.

He said that on average, when motorcycle dealerships are ranked by their PSI score, dealerships in the top quarter of the rankings sell 22 percent more motorcycles than dealerships in the bottom quarter.

“From my perspective, we are definitely rooting for the industry and have been since the beginning,” O’Hagan said. “It’s very gratifying to see the scores increase, because along with the scores increasing, sales will increase; profitability will increase, and the industry will be healthier and happier.”