Ducati dealers top PSI for the first time since 2009

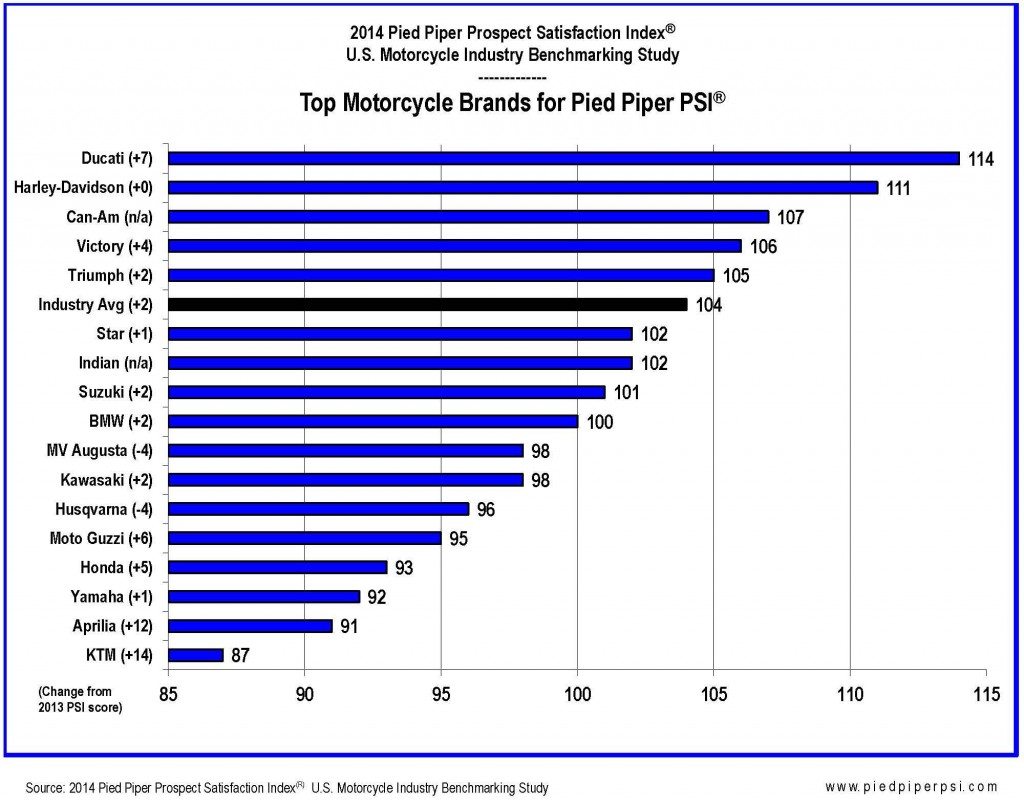

Ducati dealerships returned to the top rank in the newly released 2014 Pied Piper Prospect Satisfaction Index (PSI) U.S. Motorcycle Industry Benchmarking Study. The last time Ducati dealerships were top-ranked was 2009. The study measured dealership treatment of motorcycle shoppers, with rankings by brand determined by the patent-pending Pied Piper PSI process, which ties “mystery shopping” measurement and scoring to industry sales success.

Harley-Davidson was ranked second, with a PSI score identical to the brand’s 2013 score, which led the industry last year. Bombardier’s Can-Am brand was included in the study for the first time, debuting with a third-place ranking. Industry-wide performance improved substantially from 2013 to 2014, with twelve of seventeen motorcycle brands achieving higher scores.

Either Ducati or Harley-Davidson dealerships led all other brands in one-half of the study’s measured sales activities. Ten other brands led at least one sales process category, and brand performance varied considerably from brand to brand, including the following examples:

- Offering test rides: Recognition of the importance of test rides has driven many—but not all—motorcycle dealerships to figure out ways to overcome the challenges of offering test rides. The 2014 study showed that dealerships on average mentioned either immediate or future test rides 52% of the time, compared to only 36% of the time three years ago. However, there is much variation from brand to brand. Dealers selling five brands—Ducati, Can-Am, Harley-Davidson and BMW—mentioned test rides to more than 60% of their customers, while dealers selling Moto Guzzi, KTM, Yamaha, Suzuki and Honda mentioned test rides to less than 30% of their customers.

- Suggesting writing up a deal: Dealers selling Can-Am, Harley-Davidson, Suzuki, Ducati and Triumph were most likely to suggest going through the numbers and writing up a deal, while dealers selling KTM, Aprilia, Moto Guzzi, Victory and BMW were least likely. Industrywide, salespeople attempted to write-up a deal 39% of the time, compared to 30% of the time three years ago.

- Asking for customer contact information: Dealers selling Harley-Davidson, Ducati, Can-Am, Victory and Triumph were most likely to ask for customer contact information, while dealers selling Moto Guzzi, KTM, Suzuki, Aprilia and Yamaha were least likely. Industrywide, salespeople asked for customer contact information 52% of the time, compared to 46% of the time three years ago.

Despite the substantial industrywide progress, there remains plenty of room for improvement. Motorcycle salespeople still greet customers with, “Can I help you?” 84% of the time, a question customers often answer with, “No thanks, I’m just looking.” Similarly, salespeople still suggest sitting down at a desk only 39% of the time, mention the availability of financing options only 62% of the time, and ask for the sale only 63% of the time.

“Proactive salespeople who follow simple steps are rewarded with higher sales,” said Fran O’Hagan, President and CEO of Pied Piper Management Co., LLC. For example: when salespeople ask for the sale at least 67% of the time dealerships sell 34% more motorcycles; when salespeople ask for contact information at least 75% of the time dealerships sell 20% more motorcycles; and when salespeople offer immediate test rides at least 50% of the time, dealerships sell 44% more motorcycles.

To read more about the PSI results, check out the May 26 issue of Powersports Business.