Q4 solid; inventory levels a concern

Dealers expecting more growth in 2014

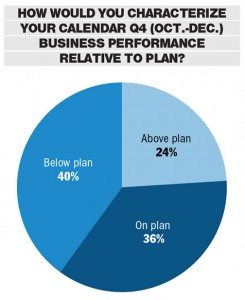

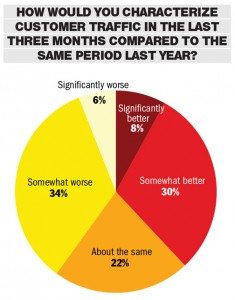

While dealers reported a mixed picture of business conditions, the Q4 2013 Powersports Business/RBC Capital Markets survey shows that volumes appear stable, and dealerships are performing above plan and have an improved outlook for the next 12 months. However, many reported increased inventory in several key product categories. The survey attracted more than 225 dealers from 46 states and four Canadian provinces.

On a product line level, Q4 appears to have been a good quarter for side-by-sides and snowmobiles, while it was more mixed for motorcycles and negative for traditional ATVs. Looking forward, dealers have an improved view on growth in side-by-side vehicles as well as motorcycles, while snowmobiles are expected to normalize somewhat following a strong 2013.

Here are some outtakes from RBC Capital Markets analyst John Kempf’s survey report:

BRP Inc.

Growth and outlook appear positive in SSV, snowmobiles

Dealers expect solid growth in Spyder. Sales of side-by-side vehicles looked good in Q4, with dealers also having a positive view on NTM [next 12 months] growth. Dealers’ views on ATV sales and the product lineup are middle of the road… . Snowmobiles seem to be a bright spot for BRP, as dealers reported strong Q4 sales and a solid NTM outlook. Dealers saw growth in Q4 sales of the Can-Am Spyder and are expecting solid NTM growth (next only to Indian Motorcycles); however, perception of the quality of the 2014 product line-up was more fairly negative (we expect because of the non-traditional niche of the Spyder).

Polaris Industries

Positive dealer response on SxS and ATV quality and growth outlook

Dealers were positive about Q4 sales of both side-by-side and ATV product lines and have a solid NTM growth outlook. With the recent launch of several new products, it is not surprising that dealers have a positive view of the relative quality of the product lineup, something that should support the NTM growth outlook. Dealers were positive on Q4 sales and have a very positive outlook for Indian motorcycles; however, this is off a base of zero. Interestingly, despite solid growth expectations, dealers had a mixed view on the relative quality of the product line. Finally, dealers saw mediocre snowmobile sales in Q4, although they have a more positive 12-month outlook.

Harley-Davidson Inc.

Optimism toward Q4 and NTM sales growth

Although results were somewhat skewed in that only 8 percent of respondents were Harley dealers, there was strong optimism among this group regarding Q4 and NTM sales. However, the picture of dealer perception of the relative quality of the 2014 product line was decidedly mixed.

Other key takeaways

Honda performing well

The side-by-side offerings from Honda again received strong responses for recent sales and expectations over the next 12 months, while also performing well in dealer quality. However, outside of Honda, dealers appear to have a more negative view of the other Asian brands (Yamaha, Suzuki and Kawasaki) across most categories.

Winning dealers

The following dealers who completed the PSB/RBC Capital Markets Q4 Dealer Survey were randomly selected to win a $100 Best Buy gift card, courtesy of RBC Capital Markets:

Donald Meyers Jr., Harley-Davidson of Baltimore, MD

Rick Cook, Iron City Polaris, Phoenix, AZ

Dan Boyle, Proshop Motorsports and Marine, Henderson, NV

Ralph Tolbert, Honda Direct Line, Bellaire, OH

Brent Rowsey, Big Delta Powersports, Batesville, MS

EDITOR’S NOTE: Powersports Business, in partnership with RBC Capital Markets analyst John Kempf, conducted its online Q4 Dealer Survey at the end of the quarter. More than 225 dealers from 46 states and four Canadian provinces completed the survey. Participating dealers sell new and/or pre-owned units from more than 40 different powersports manufacturers. Dealers who complete the survey in its entirety receive a copy of Kempf’s complete 23-page report. All dealer responses are anonymous.

Dealers who wish to participate in the Q1 2014 survey and capitalize on the benchmarks it provides should send an email to dmcmahon@powersportsbusiness.com.