Dealers see optimism with side-by-side sales

Q3 Survey shows marginally better business conditions

Editor’s note: Powersports Business, in partnership with RBC Capital Markets analyst John Kempf, conducted its online Q3 Dealer Survey at the end of the quarter. Nearly 150 dealers from 44 states and Canada participated. Participating dealers sell new and/or pre-owned units from more than 40 different powersports manufacturers. Kempf’s research note is provided below. Dealers who complete the survey in its entirety receive a copy of Kempf’s complete report. Selections from Kempf’s report on the Q3 survey follow:

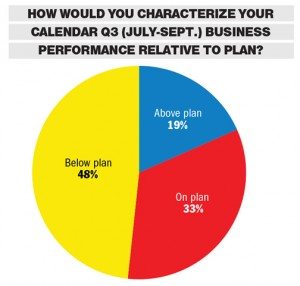

While overall sentiment was mixed, business conditions appear marginally better. Customer traffic has slightly improved, while increased buying interest was a bright spot. However, dealer profit margins appear to have deteriorated. Not surprisingly, concerns have increased regarding the current political environment and the economy, as the survey was taken during the recent U.S. government shutdown.

In particular, the outlook for side-by-sides appears healthy, driven by recent new product introductions. The outlook for traditional ATVs has also improved, while expectations for snowmobiles are strong following the return of a more typical seasonal winter last year. While dealers are somewhat optimistic on their outlook for motorcycles, current sales appear to have softened and there are concerns with inventory.

Polaris Industries

Key Takeaways

Polaris’ RZR and Ranger side-by-side vehicles are firmly entrenched as the category’s best sellers with 50 percent and 49 percent, respectively, of responding dealers stating that those models are one of their top-3 selling side-by-side products. Looking ahead, dealers’ NTM [next 12 months] expectations are similar to 3Q13 sales, with growth coming to both of Polaris’ side-by-side brands with marginally better expectations for Ranger. Polaris’ 2014 also has a perceived quality advantage over all of its competitors which may lead to increased sales efforts on the part of store workers, further driving NTM sales higher. The outlook for Victory motorcycles looks favorable, which could be a surprise kicker for near-term earnings. As for Indian, the number of responses were relatively low. Nevertheless, of the six dealers that responded to the question on sales over the next 12 months, four expect sales to increase 30 percent and one dealer expect sales to increase 20 percent.

BRP Inc.

Key Takeaways

Third quarter sales for Can-Am in side-by-sides and ATVs appear very healthy. Maverick and Commander were in the top 5 for recent sales growth, while expectations over the next 12 months were favorable for Maverick. The Can-Am Outlander also had a strong quarter, and dealer perception of the Renegade and Outlander remain very positive. The big surprise was the Can-Am Spyder, as dealers were very optimistic about sales over the next 12 months and rated the 2014 product quality second only to Harley-Davidson.

Harley-Davidson Inc.

Key Takeaways

Although results were somewhat skewed in that only 11 percent of respondents were Harley dealers, there was strong optimism among this group concerning the 2014 lineup. Q3 sales versus the prior year appeared strong, while expected sales over the next 12 months were also favorable. Not surprisingly, Harley scored best in terms of dealer perception of quality for the 2014 product lineup.

Other Key Takeaways

The Honda Pioneer side-by-side received strong responses for recent sales and expectations over the next 12 months, while performing well in dealer quality. The Yamaha Viking also appeared to have solid sales, although the quality ranking was not as high. Conversely, both the Yamaha Rhino (no longer being manufactured) and the Arctic Cat Prowler have seen recent trends and expectations erode. Honda FourTrax performed well in ATV.

Click here to purchase a full copy of the survey results.

Winning dealers

The following dealers who completed the PSB/RBC Capital Markets Q3 Dealer Survey were selected at random to win a $100 Best Buy gift card, courtesy of RBC Capital Markets:

Jeff Cheek, Bruce Rossmeyer Harley-Davidson, FL

Bob Ellis, Empire Cycle & Powersports, WA

Larry Miller, Team R&S West, NM

Craig Deghand, Salina Powersports, KS

Rob Racine, J&B Cycle and Marine, ONT

To participate in the quarterly surveys, dealers should send an email to dmcmahon@powersportsbusiness.com.