Tucker strong among metric dealers

V-twin dealers increasingly turning away non-Harley product

The latest study of vendor sales shows that seven vendors in the metric space have topped $100 million in sales for dealers in a five-year study by ADP Lightspeed analyst Hal Ethington. The report, provided exclusively to Powersports Business readers, finds that 1) vendors other than Harley-Davidson are finding it increasingly difficult to sell their product to American V-twin dealers, and 2) Tucker Rocky Distributing is holding steady as the most popular vendor choice for metric dealers.

Here are the findings from the report from ADP Lightspeed analyst Hal Ethington:

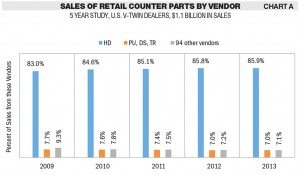

Chart A

Harley-Davidson (HD) provides more than 80 percent of parts sold across the counter in V-twin dealerships. That percentage has held, and steadily increased, over the past five years.

Three other suppliers — Parts Unlimited (PU), Drag Specialties (DS) and Tucker Rocky/Biker’s Choice (TR) — have held a consistent 7 percent share of parts sales, with the final 7 percent of sales divided among 94 other vendors.

During this five-year period, Harley-Davidson has moved up from 83 percent of dollar sales to 85.9 percent — a rise of 2.9 percentage points. These points have come at the expense of the Parts Unlimited/Tucker Rocky group, which fell 0.7 points, and the group of 94, which has fallen 2.2 percentage points.

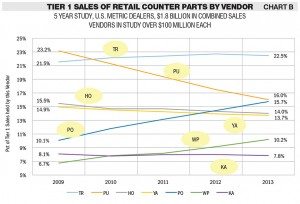

Chart B

Seven vendors in the metric space topped $100 million for dealers in the five-years of this study. They appear here, ranked by the percentage of the market they each held in each of the five years.

For the dealerships included in this study, Parts Unlimited (PU) in 2009 held 23.2 percent of the market — the highest percentage of all vendors. However, by 2013 Parts Unlimited (PU) had fallen to 16 percent, and Tucker Rocky (TR) had risen to the first spot with 22.5 percent of sales.

Polaris (PO) and Western Power Sports (WP) both rise in volume during this five-year period. Polaris rises from 10 percent of the market to 15.7 percent, a gain of more than 50 percent. Western Power Sports goes from 6.7 percent to 10.2 percent, again, a rise of more than 50 percent.

Three OEMs — Honda (HO), Yamaha (YA)and Kawasaki (KA) — have each lost about 1 percent of market share in the space since 2009.

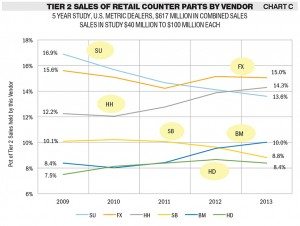

Chart C

Vendors selling less than $100 million each in the metric space are ranked here as “Tier II” vendors by ADP Lightspeed. Suzuki (SU) was first among this group with 16.9 percent of Tier II sales. In 2013 Suzuki was still ranked in the top three vendors for the group, but had fallen to 13.6 percent, behind Fox (FX) and Helmet House (HH), which had both gained market share. These top three vendors collectively held 44.7 percent of the Tier II market in 2009. In 2013 they held 42.9 percent, a drop of 1.8 percentage points.

Three other vendors are included in this Tier II group: Sullivan’s (SB), BMW (BM) and Harley-Davidson (which appears here with metric dealers because of dual line dealerships). This group of three increased their collective market share from 26 percent in 2009 to 27.2 percent in 2013.

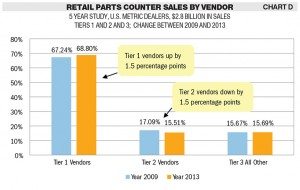

Chart D

Although Tier I and Tier II vendors account for 85 percent of all parts counter sales in this five-year period, there are another 92 vendors that provide the remaining 15 percent of sales. This chart shows the market share held by all three groups in the year 2009, and in 2013. Tier I vendors gain about 1.5 percentage points. The Tier II group dropped by the same amount. Tier III vendors remain steady at 15.7 percent of the market in both 2009 and 2013.