Sales of ‘introductory’ PWC off to promising start

Q1 industry unit sales rise by 20%, sources say

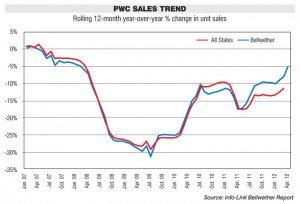

Given the general malaise that has gripped the PWC industry in the past several years, the early sales reports for 2012 should be cause for some celebration, sources say.

January saw little change, with only a small uptick reported, but February proved strong, with sales of PWC increasing by more than 30 percent. Though March appears to have dipped in the single digits, the strong February results powered the industry to a 20-percent increase over the year-ago quarter. And judging by early reports, April just might prove to be the best month yet in 2012. One slight cause for concern? There are some indications from dealer floor and website traffic that the season might be peaking earlier than usual, spiking in April rather than May. Still, as of now it’s momentum, and it’s headed in the right direction.

While specific best-selling models are heavily influenced at this time of year by what has been released and is actually available in dealer inventory, a look at what has been selling indicates some obvious, familiar trends in the market, not the least of which is the fact that lower-priced, lower-horsepower models continue to dominate sales by a substantially wide margin.

Yamaha’s VX duo of the Cruiser and Deluxe are once again proving to be favorites as they have since the inception of the VX line, with both machines firmly ensconced in the top five, while Sea-Doo’s GTI 130 and SE 130 models, both new 2012 models and leftover 2011 units, are also doing well.

In fact, season-to-date data shows that so-called “introductory” or “recreational” units are occupying eight of the top 12 sales positions, with leftover versions of Yamaha’s VX Deluxe and Kawasaki’s STX-15F also edging onto the list.

While the theory has been raised that the first quarter’s high gas prices may have skewed sales even further toward the more efficient recreational models, Josh Person of Barney’s Motorsports in St. Petersburg, Fla., disagrees.

“The PWC and boat customer don’t have the same ideology as the guy or girl coming in to buy a bike or a scooter to save gas,” said Person, a sales manager at the store along with Justin Greene. “Let’s face it, they’re well-to-do enough that they’re not thinking about gas as much as they’re thinking about their family free time. They work hard all week, and they look forward to spending Sunday with the family.”

Rather, Person argues some of the popularity of these models may be attributed to good old-fashioned sticker shock.

“I think it has a lot more to do with the fact that if you go to buy a pair of high-end models and a trailer you’re possibly spending $30,000-35,000 out the door. Ten years ago you could still buy a pair of four-stroke watercraft for $20 grand.”

A little perspective? At Barney’s, those watercraft compete with boats like an 18-foot, center-console boat that can be had, with an outboard and trailer, for only $22,000.

“Sticker shock is something that can easily happen when you’re pricing watercraft. There’s a focus on bells and whistles, but manufacturers have kind of lost sight of the price point.

I think that $10,000 and below is a magic number, and that’s why you see a lot of watercraft in that range selling well,” Person said.

That’s not to say that the powerhouse models aren’t selling. March’s data in particular shows possible pent-up demand for several models that were delivered later in the quarter, including Sea-Doo’s RXP-X 260, Yamaha’s FX Cruiser SHO, Kawasaki’s Ultra 300 and Yamaha’s FX Cruiser HO. Person notes that the FX Cruiser SHO has been selling extremely well at Barney’s.

Meanwhile Kevin Monosco, sales manager at Cal Coast Motorsports in Ventura, Calif., notes his dealership’s best-selling unit has been the Sea-Doo RXP-X 260.

“You’d think cost would be a concern until something that comes out at $14,500 is my best-seller,” Monosco said. “Motorcycles, watercraft — in my opinion, it’s all the same. First year when it’s new and exciting they sell, and they sell for most of the money most of the time. A couple years down the road that product doesn’t sell at any price unless you make it really cheap.

“People are willing to pay for something that’s exciting and new. The pricing doesn’t scare people if it’s the right product with all the new stuff. A $13,000 ski that’s the same as it was three years ago, that’s what doesn’t make sense for some people.”