Harley dealers reclaim top spot with PSI scores

H-D one of 13 brands that saw year-over-year improvement

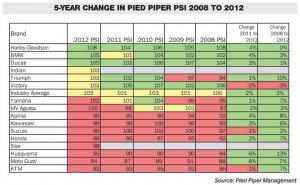

For the first time in five years, Harley-Davidson dealers have reclaimed the spot at the top of Pied Piper Management’s Prospect Satisfaction Index (PSI).

Harley topped the chart of the mystery shopping scale, with a score of 108 (135 is the highest that can be achieved), a four-point jump from H-D’s score last year.

Twelve of the 15 other brands followed in improving this year. BMW and Ducati tied for second with scores of 105, and Indian, Triumph and Victory followed, matching the industry average score of 103.

Salesmanship improves

Salesmanship scores increased the most from 2011 to 2012. Each dealership is rated on 57 aspects, 22 of which focus on salesperson selling. The study found significant improvement in these five areas: salespeople were 22 percent more likely to ask about factors preventing a sale, 19 percent more likely to mention the availability of different financing options, 14 percent more likely to give customers a reason to buy from their dealership, 13 percent more likely to ask for the sale and 11 percent more like to give a compelling reason to buy now.

“Of the 57 different aspects we measure, those were the five that had the largest increase from year to year,” said Fran O’Hagan, president and CEO of Pied Piper Management Co. LLC. “We’re talking about powerful, important changes.”

O’Hagan said the two-point industry average improvement shows dealers are learning to handle the changes that have occurred in the industry since the recession began, and they’re working at better salesmanship with smaller staffs.

“The industry has really changed from 2008 to today. I think over the past two, three years there was a lot of fear and loathing and gnashing of teeth and ‘Woe, is me,’” he explained. “I think starting last year everyone in the industry sort of pulled up their boots and decided, ‘Hey, this is the new reality, and we’re just going to make the most of it.’ And if we look at what happened last year to this year, that’s where you’ll see a dramatic change.”

Harley and test rides

Harley dealers in particular focused on salesmanship more this year than last.

“If we look at what Harley did differently in the 2012 study compared to the year before, we see a lot of changes in behavior that drove the industry change,” O’Hagan said, adding that when H-D dealer scores increase, the industry as a whole is positively effected.

Harley-Davidson dealers were 30 percent more likely to give reasons to buy now, 27 percent more likely to ask for the sale and 20 percent more likely to offer a test ride when compared to last year.

“These are the meaty, heavy-hitting sales changes that are happening. These are the things that sell motorcycles,” O’Hagan said.

Test rides are a key part of making a sale that Harley improved upon this year. O’Hagan said in a previous study, Pied Piper focused on test rides and their effects on sales. Dealers that offered test rides at least 50 percent of the time saw 37 percent more sales.

This year’s PSI survey found only 16 percent of dealers offered a test ride during the initial visit by the prospect, and 20 percent offered to schedule a future test ride. Three in 10 didn’t even offer customers a seat on a bike. O’Hagan pointed out that by not making the buying experience interactive, dealers are losing sales.

“If you have somebody sit on a motorcycle, it dramatically increases the chance of selling to them. If you allow someone to ride a motorcycle, it increases your chance to sell to them. If you put a motorcycle piston in their hands, it increases your chance to sell to them,” he said.

Other brands see progress

Though Harley led the pack, it wasn’t the only brand to see improvement. The company actually held steady with a zero percent increase from five years ago. Husqvarna saw the largest improvement from 2008-12, with a 13 percent hike during that period from 84 points to 95.

“To see Husqvarna go from 90, 90, 90 and jump to 95, that definitely says something is happening at those stores,” O’Hagan said, referring to the brand’s scores from 2009-12.

Triumph also reported double-digit growth with a 10 percent hike over five years from 94 to 103.

Star Motorcycles earned a score of 98 during its first year on the index. Yamaha had requested that Yamaha bikes and Star Motorcycles be separated to better analyze the sub-brand’s sales. Yamaha scored higher of the two, with 102 points.

Indian Motorcycles also saw its debut on the index this year, matching the industry average and its sister Polaris brand, Victory, with a score of 103. Indian was measured last year, though the brand didn’t appear on the index. Because the brand has such a small dealer network, dealerships often had to be visited two or three times for Pied Piper to get a large enough sample.

“Indian’s score last year was exactly the same, so in pre-Polaris and post-Polaris, it’s the same scores,” O’Hagan explained.

Overall, with increases nearly across the board, this year’s PSI scores show the industry is seeing notable improvement with its salesmanship, though O’Hagan says higher goals could be achieved.