First-time buyers fuel ATV sales

Following strong ATV retail registrations in the first quarter 2004 (up 7.8%, against an easy first quarter 2003), second quarter 2004 registrations were down approximately 5%.

Despite year-to-date retail sales through June being up only 0.5%, we feel comfortable that a second half recovery in the ATV market in 2004 will materialize and that our full-year growth assumption of 5.2% is achievable for these reasons:

Since March 2004, consumer confidence has risen steady through June as consumers are becoming increasing confident in the job market and overall income growth (two primary drivers behind the increase in confidence).

Based on industry unit sales back to 1982, ATV retail unit sales show a relative immediate correlation to consumer confidence. Clearly the data demonstrates that changes in consumer confidence have more of an immediate and not lagging impact on retail sales (U.S. unit ATV sales 50%-55% immediately correlated to consumer confidence).

Our dealer rating for sales declined to 6.5 overall versus 7.2 in July 2003 as several dealers noted that sales/floor traffic noticeably decline in May/June versus earlier in the year.

Dealer sales rating declined most notably in Northeast (5.0 versus 6.7), with dealers citing weather as potential reason for the decline. The South/Southeast (6.1 versus 7.5) and Upper Midwest (7.0 versus 7.3) regions also showed modest decline in dealer sales ratings. We did see a moderately positive change occurring in Mountain Pacific region (7.7 versus 7.4).

Despite the weaker than expected sell-through in first half 2004, Dealers indicated that inventory levels remain manageable with a dealer rating of 6.9, though down from July 2003 rating of 7.4.

Promotional activities

Overall, major competitors remain rational in regards to the promotional environment, however Polaris will roll-out aggressive incentives in third quarter 2004 as part of its “Factory Authorized Clearance.”

This is planned to run Aug. 1 – Sept. 30 to assist dealers in cleaning out 2004 models in preparation of its new 2005 model introduction. Approximately 60% of PII’s 2005 ATV line-up is brand-new. The Polaris program offers both financing and customer rebates on most ATV, PWC, and sled models.

We expect this aggressive promotional activity to only be temporary in 2004, however we feel the timing and level of promotional activity from Polaris will become more commonplace near the end of a given model year going forward (financing /incentive programs modeled similar to car manufacturers) in preparation of new product launches.

There could be a temporary increase in promotional activity in second half 2004 as major competitors react to Polaris new incentive program as well as attempt to accelerate retail activity given the soft first half 2004.

Dealer order outlook

Our dealer rating for anticipated orders of 3.2 was down slightly from 3.4 in July 2003 and 3.3 in January 2003. We feel comfortable that overall dealers will continue to growth their orders at a moderate rate, balancing anticipated retail demand and inventory management.

Again, we are not hearing of significant demand correction, but continued tempered optimism for second half 2004 and full-year 2005. We would also note that our dealer survey was completed prior to Polaris new 2005 ATV model introductions and new financing program. Therefore, dealers maybe more willing to order new machines given the likelihood that they will have less 2004 carry-over the previously anticipated.

We believe that 2005 retail unit growth of 5.7% for the industry is achievable. Competition remains tight among manufactures, especially among the top three: Honda, Yamaha, and Polaris, which effectively control 80% of the total market.

We believe that Polaris will gain back some market share beginning in second half 2004 through 2005 given its strong new 2005 model introductions both in the heavyweight segment (Sportsman 800 EFI, Sportsman MV) as well as the youth segment driven by new Phoenix 200.

We feel the most likely other candidate to pick-up share is Artic Cat based upon dealer conversations, new product introductions and ACAT’s shift in overall company strategy to focusing on ATV’s and less on Snowmobiles (given overall market growth opportunity much greater in ATV’s).

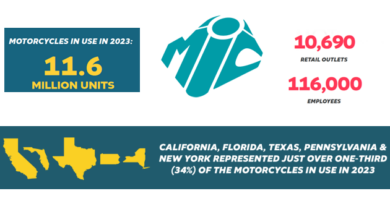

We believe U.S retail unit ATV growth over the next several years (as reported by Motorcycle Industry Council) will approximate mid-single digits in a normalized economic environment as this segment, though maturing, remains the most under penetrated of the three major powersports segments (30%- 35% of purchases are from first time buyers) and serves a wider variety of purposes when compared to snowmobiles and watercraft. PSB