Black Friday sales rise for dealers who opened

Dollars and sense

Hello! McFly, it’s Black Friday!

What are some of you guys thinking? It’s the biggest retail day of the year, and you’re goofin’ off. You’re out putting miles on the demo, while your own doors are closed. Shut tight. You think that the whole Black Friday thing doesn’t apply to you?

Think again.

Nine percent of metric motorcycle dealers were closed on this huge retail day according to ADP Lightspeed data. OK, I get it. So were swimming pool supply stores. And wholesale medical. And scuba diving shops. In Wisconsin.

Does that make you feel better?

Last year, 5 percent of metric dealerships were closed. It almost doubled this year to 9 percent for reasons that are beyond me. Harley folks? They get it. Only 2 out of 179, less than 1 percent, were closed. Give those two a pass on this. Maybe they were snowed in — or something. But what about the 77 metric dealers out of 910 that didn’t show up? No pass for you guys. Look at what you missed.

On Black Friday this year, the top 10 percent of V-twin folks in my survey of 177 dealers participating in Black Friday sold seven times in parts what they sold the previous Friday (Nov. 18). For metric, dropping the 77 closed shops from my sample of 910, the top 10 percent of the remaining 833 metric dealers did almost as well, selling five times what they sold the week before. Metric dealers, go back to Friday the 18th, look at your sales and multiply them by five. Now, we are only talking P&A here, but get the picture?

Here’s how it looks:

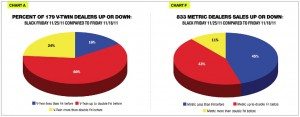

In Charts A and F, we see metric and V-twin dealers who came out with sales below, double, or more than double their sales of Friday the 18th. Among metric (Chart F), almost half (45 percent) had sales below what they did on the 18th, and I’m guessing it’s because their customers were over at the fancy retailers. They know there’s nothing special going on at your place. V-twin dealers did better (Chart A), where only 16 percent had sales below what they did on the 18th.

The good news is that 43 percent of metric dealers ranged from flat up to double the sales from the 18th, with 11 percent breaking through to more than double the sales. V-twin dealers scored big here, with 60 percent up to double, and 24 percent seeing even more sales.

Got your attention?

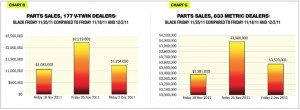

Charts B and C show the tremendous difference this day makes in the V-twin world. Looking at the full group of 177 dealers, we see that Black Friday parts sales are more than double what they were on the 18th. And, when you pare that down to the top 10 percent of dealers in Chart C, we see that 716 percent increase I mentioned above — seven times the sales of Friday the 18th. You can bet that didn’t happen by chance. Somebody has been working on that since August.

Charts G and H shift to the metric world, where the numbers are almost as good. For the 833 dealers in Chart G, we see sales jumped from $3.4 million to $4 million — about an 18 percent increase. But again, when you pare that back to the top 10 percent of dealers, those 83 stores jumped 495 percent above Friday the 18th. Again, not bad. A lot of work and a lot of preparation led to solid results.

Now, let’s take a step back and look at this from another perspective.

If we take the stores we surveyed last year, and see how they did this year, we can see how Same Store Sales for Black Friday are trending. And the message is clear: Get on board; this train is leaving the station.

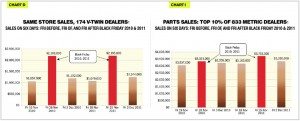

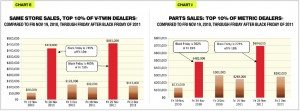

To get the whole picture, I’m going to group the three Fridays in 2010 (the week before, day of and week after Black Friday) and compare them to the same three Fridays in 2011. For the V-twin total group in Chart D, $4.4 million grew to $4.5 million between the two years (you can add the three days up to check). Call it level? It’s really up 2 percent, but OK. Now, take a look at the top 10 percent of V-twin dealers in Chart E. They went from $598,000 to $673,000. That is a 13 percent increase between the two years. Hmm.

But the real story is in metric. Excluding dealers who do not appear in both years, the group drops from 833 to 761 and they are presented in Chart I. Sales there went from $9.6 million in 2010 to $10.2 million in 2011 for a nice 7 percent increase. But that’s nothing when compared to the movers and shakers — the top 10 percent. Those dealers, 76 of them in Chart J, went from $916,000 in 2010, to (drum roll here …) more than $1.2 million in 2011. That’s a 34 percent increase boys and girls. And they did it in the metric market after getting a taste of it last year.

So the meat and potatoes are on the table. It’s up to you to pull up your chair, grab a fork and dig in.

Happy Holidays. I’m pretty sure we’ll talk about this again next year.

Hal Ethington has been associated with the powersports industry for more than 30 years. Ethington is a senior analyst at ADP Lightspeed. He can be reached at Hal_ethington@adp.com.