Using online tools and analytics to compete in a digital world

It’s clear that the way business leaders obtain information has changed dramatically, with 85 percent of chief financial officers (CFOs) in a GE Capital survey reporting that online news is their single most important information resource.

Webinars are their preferred option, followed by blogs and online-only magazines because of their timeliness and accuracy.

Ultimately, business leaders are trying to find efficient ways to tap useful business intelligence in a world of data overload. Fortunately, a new breed of business intelligence tools is helping to provide powersports dealers with a competitive edge.

The importance of connecting the dots

By combining a careful analysis of industry-level data with decades of experience in the inventory finance business, this article outlines some of the most important financial metrics that dealers should be aware of, including gross margin, leverage, inventory aging and inventory turns.

While the ideal ratios will be unique for each individual business, dealers can measure their performance against a broad cross-section of their peers and analyze the health of their own portfolios.

To avoid analysis paralysis, dealers may choose to focus on the data that can provide the most actionable insights. For example, knowing how volume is trending and how many orders are being filled is important. Even better: Knowing how fast inventory is turning overall, and which products are selling compared to which ones are aging.

Taken together, the right data may enable dealers to connect the dots and look at their businesses in new ways. For example, a dealer can compare inventory turns to financing terms, and calculate whether products are selling before financing penalties come due. This gives the dealer a way to better measure cash flow and determine the underlying health of the business.

The right data at the right time

Dealers should decide which financial ratios and metrics are most relevant so they can track them over the long term. Generally, three of the most important ratios for businesses of any size are gross margin, leverage and earnings before interest, taxes, depreciation and amortization (EBITDA).

Based on GE Capital’s experience in the powersports industry, these indicators appear to have stabilized over the past several years. Leverage (debt over equity) has shifted from 2009 levels due partially to higher debt and a lower tangible net worth.

The median gross margin is 22.2 percent compared to 25.9 percent in 2009. The change could be due to slight increases in the cost of goods sold (COGS) and discounting to move aged inventory. EBITDA performance is 5.9 percent up from 2.7 percent in 2009. The improvement could be attributed to management efforts to reduce operating expense.

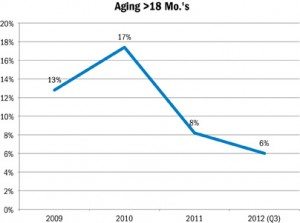

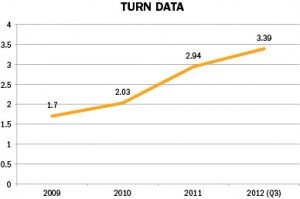

Dealers can also measure their performance against a broad cross-section of their peers by examining inventory aging and inventory turnover. Both metrics have shown steady improvement from 2009 to today. Turns have increased, and inventory aged more than 18 months has decreased, indicating that the overall U.S. powersports industry is healthier.

To continue to improve, dealers should focus on reducing carrying costs on aged inventory while also reducing the frequency of lost sales because they have insufficient inventory on hand.

Aging is the number of days it takes for a dealer to sell a product that it’s holding as inventory; this figure is typically tracked monthly. Limiting the number of older products sitting in inventory ensures that powersports dealers have capacity to take advantage of new product launches and promotions that come up in the course of a year.

Aging is the number of days it takes for a dealer to sell a product that it’s holding as inventory; this figure is typically tracked monthly. Limiting the number of older products sitting in inventory ensures that powersports dealers have capacity to take advantage of new product launches and promotions that come up in the course of a year.

It’s important for dealers to have the optimum mix of products on hand for their retail customers so some level of aging is expected. However, excessive aging will tend to increase the cost of carrying inventory, which, in turn, may mean lower profit margins.

Inventory turnover, commonly called turn, shows how many times a company’s inventory is sold and replaced over a period of time, typically annually. Maximizing product turn — in other words, increasing sales by selling through inventory — allows dealers to order new inventory and thereby respond quickly to ever-changing retail trends.

Other areas that can be important when looking to the future are business plans — particularly for new entrepreneurs — and succession plans — particularly for mature dealerships. Finally, having a roadmap for retaining valuable employees is also important. These strategic plans complement the financial and performance-based considerations that go into building strong and lasting businesses.

Other areas that can be important when looking to the future are business plans — particularly for new entrepreneurs — and succession plans — particularly for mature dealerships. Finally, having a roadmap for retaining valuable employees is also important. These strategic plans complement the financial and performance-based considerations that go into building strong and lasting businesses.

Conclusion

It’s important to note that this article is based on GE Capital’s experience in the powersports industry and is for informational purposes only; it does not constitute legal, tax, financial, or business advice. The ranges and percentages mentioned here are based on an average for dealers of all sizes.

It’s necessary to consider a number of factors when assessing the overall health of a business, but these ratios can serve as guideposts for dealers who want to measure themselves against the powersports industry as a whole. Dealers with different financial ratios aren’t inherently stronger or weaker than their peers.

Ideally, dealers should use a combination of performance measures and analytics to guide the decision-making process. Identifying the most important metrics and effectively monitoring them with reliable tools will allow dealers to spend more time focusing on the customer experience and implementing sales strategies to foster growth.

Judith Toland is the customer experience leader at GE Capital, and Sameer Gaur is the motorsports commercial leader of GE Capital, Commercial Distribution Finance.